Spending patterns change during restrictions and lockdowns but Aussies keep up their DIY, according to CBA’s latest credit and debit card spending analysis.

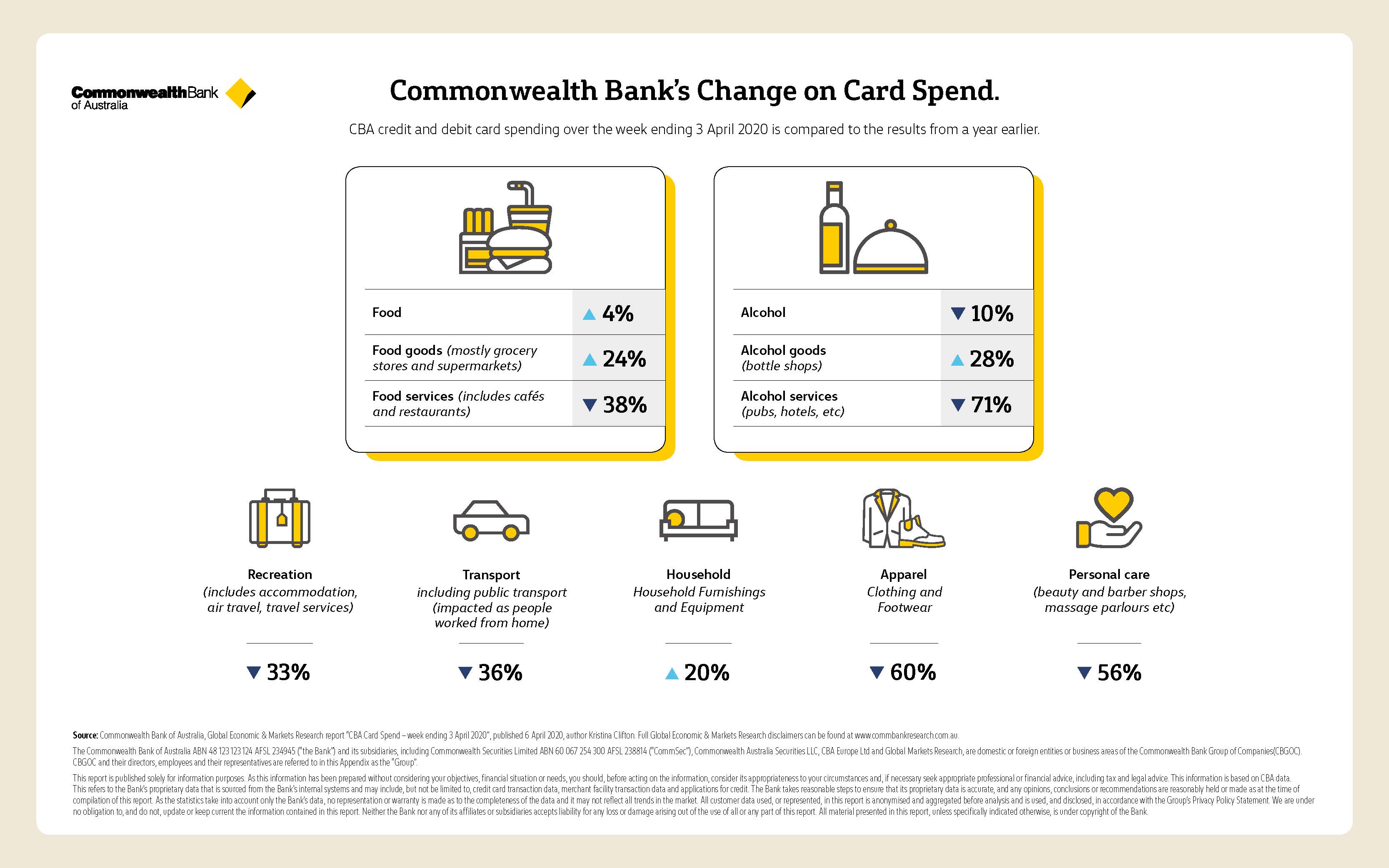

The latest credit and debit card spending analysis from Commonwealth Bank’s Global Economic and Markets Research team shows that while Australians appear to be spending less overall during restrictions and shutdowns, they are spending more on DIY and home improvements. The spending analysis for last week – week ending Friday 3 April – also highlights a continuing sharp fall in spending on services, with both food and alcohol sales declining in the last few weeks.

CBA Senior Economist Kristina Clifton says that some of the spending patterns that emerged early on in the period of restrictions and lockdowns are now reversing.

“While food spending is still up around four per cent compared to a year ago, people may now feel they have enough grocery items in reserve. Spending on food fell by 12 per cent over the week, following a 21 per cent fall from the previous week.”

Spending on alcohol also dropped over the week, down 33 per cent compared to the previous week, following two weeks of very strong spending.

“Consumers may feel like they have enough alcohol stocked up and the fact that many businesses are pivoting to build digital businesses and implementing contactless delivery services may be providing further reassurance. Restrictions on activity have also been ramped up and people are no longer allowed to socialise with those that they don’t live with. There will be fewer barbecues, parties and other social occasions,” said Ms Clifton.

However, Ms Clifton says that spending on DIY and renovations remains strong.

“Although spending on household furnishing and equipment was down seven per cent on the previous week, compared to the same week last year it is up 20 per cent,” said Ms Clifton.

“Some categories of spending seem less affected by the coronavirus. These included education, utilities, communications and household services and operation,” Ms Clifton added.

Additional insights from CBA credit and debit card spend data

- Overall spending was down 13 per cent in the week ending Friday 3 April compared to the previous week and 15 per cent lower than a year ago.

- Spending on household furnishing and equipment fell by 7 per cent in the week ending Friday 3 April compared to the previous week.

- Spending on medical and health was down 27 per cent, transport down 17 per cent and recreation down 10 per cent, in the week ending Friday 3 April compared to the previous week.