Residents of Western Australia’s 6011 postcode made $206, 350 525 in tax-deductible donations for the 2016-17 financial year and topped the country for donations by postcode.

New South Wales was the highest donor state where 1,452,522 taxpayers claimed $1.24 billion in tax-deductible donations and increase from $1.11 billion in 2015-16.

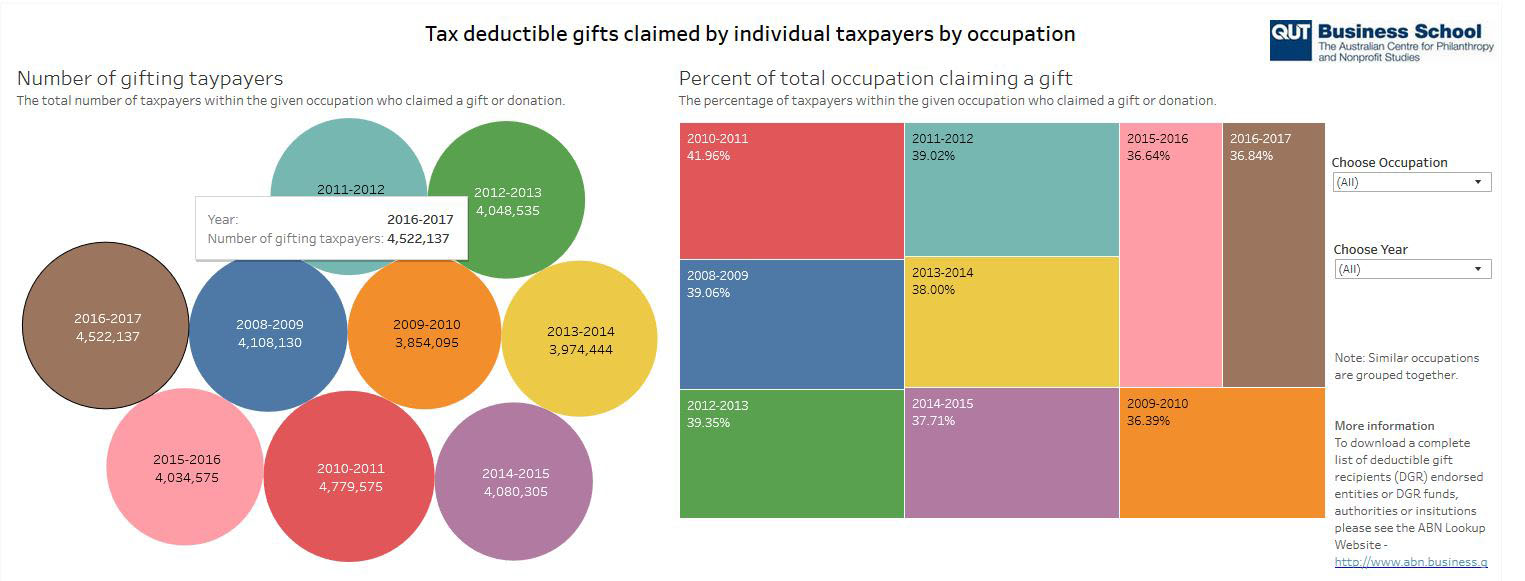

The annual analysis by QUT’s Australian Centre for Philanthropy and Nonprofit Studies (ACPNS) of ATO data has recorded a 21.8 per cent increase in donations from the previous year.

- A total of $3.5 billion was donated in the 2016–17 financial year, which represented a 21.8 per cent ($623 million) increase on the previous year.

- The percentage of Australian taxpayers making deductible gifts has been in decline since 2011-12, decreasing from 33.40% in 2015–16 to 32.60% in 2016–17.

- The average tax-deductible gift amount was $769.99.

- Men gave 0.43 per cent of their income, while women gave 0.41 per cent of their income.

- The analysis is based on ATO data from individuals’ income tax returns and does not include giving by corporate and trust taxpayers nor non-deductible donations, such as raffle tickets, sponsorships and volunteering. Total giving (including non-tax giving) in 2016 was estimated to be $11.2 billion.

ACPNS director Associate Professor Wendy Scaife said the 6011 postcode in WA which had the highest tax-deductible donations included the high-income suburbs of Cottesloe and Peppermint Grove.

“The analysis also showed that chief executives and managing directors once again claimed the most tax deductible donations, at $395.38 million. They also made an average donation of $7,871.56, the highest of any occupation,” Professor Scaife said.

“When it comes to occupations with the highest percentage of donating taxpayers, police came out on top for the seventh year in a row, with almost three-quarters of officers giving, followed by machine operators and school principals.

“The Sunshine State gave a total of $401.38 million in deductible gifts but, interestingly, Queensland was once again the second lowest on the list when it came to the percentage of taxable income donated. It managed just 0.26 per cent, compared to the national average of 0.43 per cent.”

The community can check out individual postcode giving statistics here Data on tax deductible giving by postcode

To see how your occupation rates, check out, Tax deductible giving by occupation.

Highest TOTAL Tax-Deductible Donations by State 2016–17 | ||

Total Donations ($million) | Average Donation ($million) | |

New South Wales | 1,243.86 | 856.35 |

Victoria | 1,013.94 | 797.95 |

Queensland | 401.38 | 486.55 |

South Australia | 149.89 | 528.35 |

Western Australia | 527.76 | 1,189.82 |

Tasmania | 43.81 | 495.56 |

Northern Territory | 17.84 | 404.85 |

Australian Capital Territory | 72.70 | 689.83 |

Highest TOTAL Gifts Claimed by Taxpayers 2016–17 by POSTCODE for each State | |||

State & Postcode | Places within Postcode | Total Gifts Claimed ($) | |

NSW | 2041 | Balmain East, Birchgrove, Balmain | $76,864,431 |

VIC | 3148 | Chadstone, Holmesglen, Chadstone Centre, Jordanville | $117,559,383 |

QLD | 4007 | Ascot, Hamilton, Hamilton Central | $21,224,595 |

SA | 5063 | Eastwood, Fullarton, Frewville, Parkside, Highgate | $6,401,786 |

WA | 6011 | Cottesloe, Peppermint Grove | $206,350,525 |

TAS | 7250 | Blackstone Heights, East Launceston, Launceston, Newstead, Norwood, Prospect, Prospect Vale, Ravenswood, Riverside, St Leonards, Summerhill, Trevallyn, Travellers Rest, Waverley, West Launceston, | $5,002,131 |

NT | 870 | Araluen, Alice Springs, Braitling, Ciccone, Desert Springs, East Side, Gillen, Sadadeen, Stuart, The Gap, White Gums | $3,540,400 |

ACT | 2602 | Ainslie, Dickson, Downer, Hackett, Lyneham, O’Conner, Watson | $7,944,560 |

Other suburb and occupation data is available from the ACPNS.

A copy of the ACPNS tax-deductible giving report, containing analysis of tax-deductible giving by postcode, gender, state and occupation, is available for download.