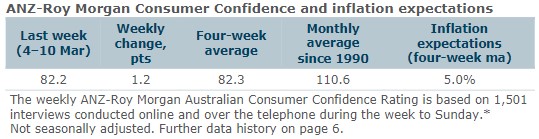

Consumer confidence rose 1.2pts last week. The four-week moving average declined 0.1pts.

‘Weekly inflation expectations’ was unchanged at 4.9%, and the four-week moving average was unchanged at 5.0%.

‘Current financial conditions’ rose 3.1pts. ‘Future financial conditions’ jumped 4.4pts rising above the neutral 100 level to its highest since January 2023.

‘Short term economic confidence’ (about the economic outlook over the next 12 months) was practically unchanged with a 0.1pt increase.

‘Medium term economic confidence’ (about the economic outlook over the next five years) was down 1.4pts.

The ‘time to buy a major household item’ subindex softened 0.3pts.

ANZ Senior Economist, Adelaide Timbrell said: “ANZ-Roy Morgan Australian Consumer Confidence rose slightly over the week but is still broadly trending sideways. Confidence in future finances, which measure how many participants believe their own finances will be better in a year from now, was at its highest level since January 2023. It also hit above its neutral 100 level, meaning more optimistic participants than pessimistic ones.

Inflation expectations have settled lower this year, signalling confidence in the battle against inflation. Economic confidence fell after the weak GDP result out last week (GDP was up 0.2% q/q or 1.5% y/y). We expect GDP to be soft for the first half of the year before tax cuts, other fiscal stimulus and falling inflation help household incomes and spending.”