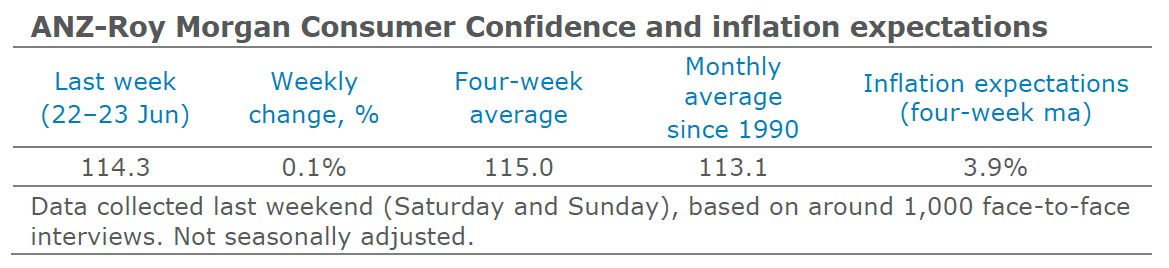

Weekly consumer confidence was essentially unchanged last week, gaining just 0.1 per cent. Within this stable headline result there was quite a bit of movement in the sub-indices. Those relating to personal financial conditions were stronger, while those looking at the economic outlook fell.

Current financial conditions rose by 4.7 per cent, while future financial conditions gained 0.2 per cent. Both financial condition sub-indices have been positive for two straight weeks.

Economic conditions were weak, with current economic conditions down 6.9 per cent and future economic conditions falling 5 per cent. Both the sub-indices are below their long-term averages.

The ‘time to buy a major household item’ was up sharply, jumping by 6.1 per cent. It has not been above its current level since July last year. The four-week moving average for inflation expectations rose to 3.9 per cent.

“Confidence was effectively unchanged last week but the stability hides quite a lot of variance in the sub-indices,” ANZ Head of Australian Economics, David Plank said.

“People were much more positive on their own financial circumstances, but unsure about the economic outlook. This may reflect the way lower interest rates are being perceived: positive at the individual level for many (though not all) but the fact that interest rates need to fall is possibly raising concerns about the economic fundamentals.”

“The bounce in the ‘time to buy a major household item’ may be indicative of the signs of stability in the housing market emerging in other data such as auction clearance rates.”

“The weekly reading of inflation expectations jumped by 0.3 percentage points to 4.3 per cent. This took the four-week moving average to 3.9 per cent.”