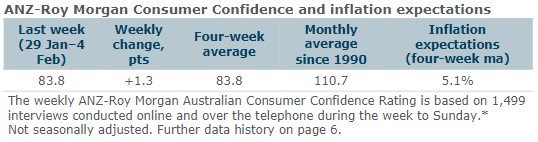

Consumer confidence rose 1.3pts last week. The four-week moving average was down 0.3pts.

‘Weekly inflation expectations’ fell 0.2ppt to 4.9%, while the four-week moving average was unchanged at 5.1%.

‘Current financial conditions’ were up slightly by 0.7pts, while ‘future financial conditions’ dropped 2.9pts.

‘Short term economic confidence’ (about the economic outlook over the next 12 months) gained 3.1pts. ‘Medium term economic confidence’ (about the economic outlook over the next five years) jumped 4.8pts, after a cumulative decline of 7.2pts over the previous three weeks.

The ‘time to buy a major household item’ subindex increased 0.6pts.

ANZ Senior Economist, Adelaide Timbrell said: “ANZ-Roy Morgan Australian Consumer Confidence increased last week, driven by a rise in confidence about the future of the economy. Future financial confidence also rose, perhaps influenced by the change to Stage 3 tax cuts, which reduce taxes compared to the original cuts for all employees earning under AUD150,000 a year.

“We expect the RBA to hold rates at 4.35% today, which would help confidence for indebted homeowners, who on average now have higher confidence than renters for the first time since mid-2022. Inflation expectations are down to their lowest four-week average since February 2022.”