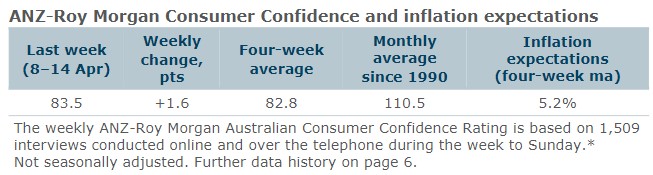

• Consumer confidence increased 1.6pts to 83.5pts. The four-week moving average rose 0.4pts to 82.8pts.

• ‘Weekly inflation expectations’ fell 0.1ppt to 5.2%, however the four-week moving average increased 0.1ppt to 5.2%.

• The financial conditions subindices both increased. ‘Current financial conditions’ (over last year) increased 5pts and ‘future financial conditions’ (next 12 months) were up 1.6pts.

• ‘Short term economic confidence’ (next 12 months) decreased 1.2pts, while ‘Medium term economic confidence’ (next five years) rose 1.0pts.

• The ‘time to buy a major household item’ subindex increased 2.1pts.

ANZ Economist, Madeline Dunk said: “Despite a small lift in ANZ-Roy Morgan Consumer Confidence, the series remains stubbornly weak, averaging just 83pts in 2024. While this is higher than 2023’s 78pt average, it is still 30pts off the series’ pre-COVID (1990-2019) average of 113pts.

Last week’s rise in confidence was driven by a lift in the financial condition’s subindices, with current financial conditions increasing 5pts. Weekly inflation expectations took a small step down to 5.2%, although the four-week moving average rose toa three-month high.”