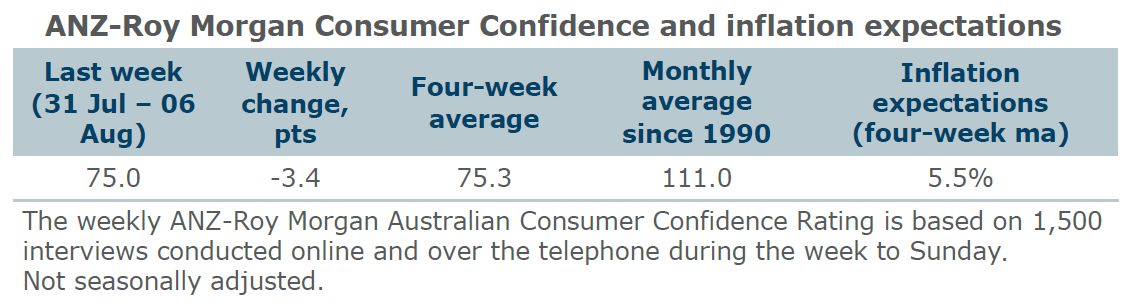

Consumer confidence decreased by 3.4 points last week. Confidence was down across all the mainland states – New South Wales, Victoria, Queensland, South Australia and Western Australia.

‘Weekly inflation expectations’ decreased 0.1 percetnage points to 5.4 per cent. The idexes’ four-week moving average was unchanged at 5.5 per cent.

‘Current financial conditions’ plunged 6.9 points, while ‘future financial conditions’ dropped 9.6 points. This follows two weeks of strong gains in both financial conditions.

‘Current economic conditions’ softened 0.7 points after three straight weeks of gains. ‘Future economic conditions’ were up 2.1 points, rising above 90. ‘Time to buy a major household item’ fell 2 points after a 5.5 point gain the week before.

“ANZ-Roy Morgan Australian Consumer Confidence declined last week, despite the Resever Bank of Australia’s decision to keep the cash rate on hold,” ANZ Senior Economist Adelaide Timbrell said.

Homeowners with debt still have far lower confidence than other cohorts, as restrictive interest rates squeeze cashflows of indebted households.

Confidence has been in very weak territory (below 80) for 23 consecutive weeks, the longest weak streak on record. Western Australia ended the week with the highest average confidence while Queensland had the lowest. Average confidence fell among all the housing cohorts, but the biggest fall was among renters (down 9.4 points) after a jump in the previous week.