Confidence fell only 0.4 per cent over the past week – a somewhat surprising result given the news flow around the outbreak of the coronavirus. The Federal Government’s fiscal package may have contributed to the resilience.

‘Current economic conditions’ fell 9.3 per cent, adding to a decline of 8 per cent and 16.6 per cent in the previous two readings. ‘Future economic conditions’ strengthened for the second week in a row rising 2.1 per cent.

Financial conditions subcomponents diverged, with ‘current financial conditions’ gaining 3 per cent while ‘future financial conditions’ declined 0.5 per cent.

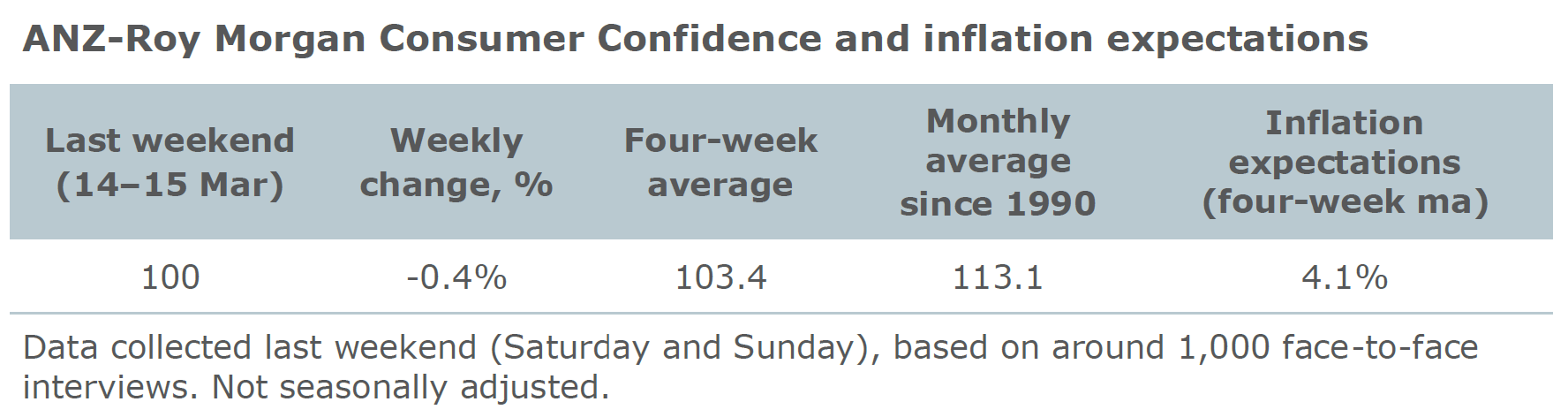

‘Time to buy a major household item’ fell by 0.2 per cent, its third straight weekly loss and is at an 11-year low. The four-week moving average for ‘inflation expectations’ was stable at 4.1 per cent.

“Despite all the gloom last week, confidence only fell marginally,” ANZ Head of Australian Economics David Plank said. “It is, however, at its lowest level since 2009. This is the more-important point.”

“The weakness was predominantly due to another sharp drop in the current economic conditions subcomponent. This component is now approaching the lows seen during the GFC.”

“The divergence between financial and economic conditions remains large. The labour market will likely determine how that gap is closed, which makes this week’s employment data important.”

“We are expecting bad news, with an outright drop in employment likely. Offsetting this may be a further stimulus package from the Federal Government, which will add to the fiscal stimulus now being delivered by a number of states. The RBA is also set to cut to 0.25 per cent and announce QE on Thursday.”