CBA’s latest Household Spending Intentions Series shows early but clear impacts from coronavirus and Australian bushfires.

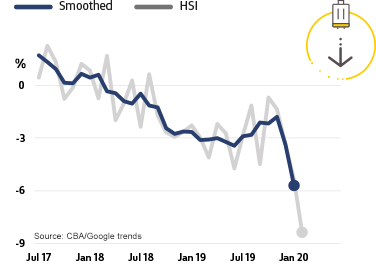

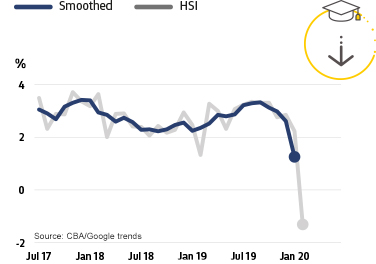

Coronavirus and recent Australian bushfires are two key drivers of a sharp decline in travel and education spending intentions, according to the latest monthly data from the Commonwealth Bank Household Spending Intentions (HSI) Series.

Commonwealth Bank Chief Economist Michael Blythe says both the education and travel spending intentions declined most sharply in February, building on the dip already seen in January. Mr Blythe also confirmed that the February travel HSI readings were the lowest since the series began in 2015.

“Along with tourism, the education sector is particularly exposed to the negative effects of the coronavirus. That exposure is now showing up in a sharp downgrade to education spending intentions,” said Mr Blythe.

The rate of growth in education spending intentions has slowed sharply in recent months but remains in positive territory. “CBA transactions data reveals that spending declines in areas associated with universities and colleges is partly offset by higher spending on correspondence schools,” said Mr Blythe.

“The emerging consensus is that the bushfires probably knocked 0.2 percentage points off economic growth over Q4 2019 and Q1 2020, and the virus could take a further 0.5 percentage points out of Q1 2020,” said Mr Blythe.

“The consensus is also that the sectors most affected by these natural disasters are tourism and international education. The tourism and education sectors account for 5 per cent of GDP and 7 per cent of total employment,” Mr Blythe added.

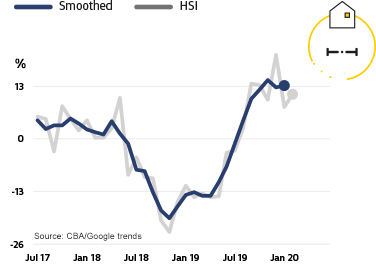

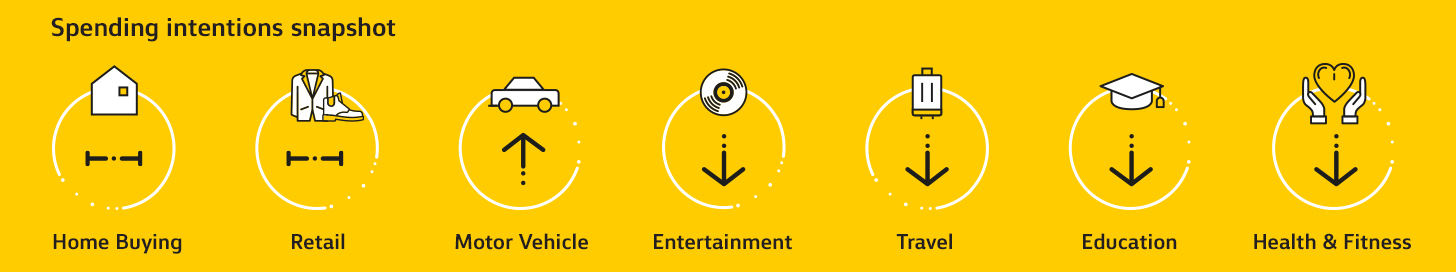

“More positively, the home buying spending intentions series remained near the top of its historical range, while the motor vehicle spending intentions series continues to improve. Retail spending intentions remain at low levels, while health & fitness spending intentions and entertainment spending intentions are both now also weakening.”

The HSI series offers a forward-looking view by analysing actual customer behaviour from CBA’s transactions data, along with household search activity from Google Trends. This combination adds to insights on prospective household spending trends in the Australian economy.

Household Spending Intentions

CBA obtains an early indication of spending trends across seven key household sectors in Australia. Apart from home buying, the series covers around 55 per cent of Australia’s total consumer spend across; retail, travel, education, entertainment, motor vehicles, and health and fitness.

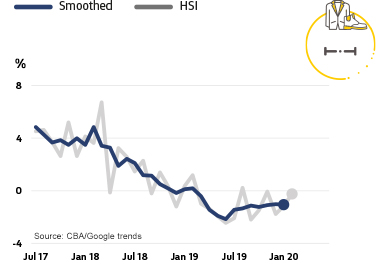

Retail Spending Intentions

|

Travel Spending Intentions

|

Home Buying Spending Intentions

|

Education Spending Intentions

|

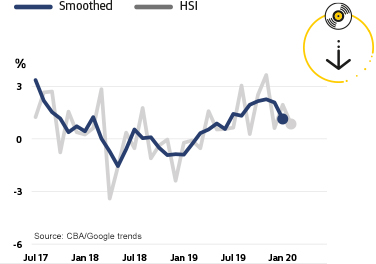

Entertainment Spending Intentions

|

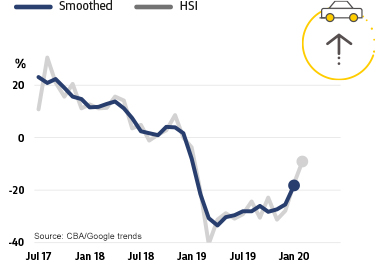

Motor Vehicles Spending Intentions

|

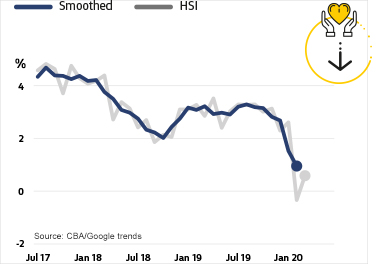

Health & Fitness Spending Intentions

|