Ashurst waste team has closed 34 projects, bringing the Ashurst total to 62 since 2002.

Over the last year, the Ashurst waste team has helped to close Doveryard EfW (Scotland), Westfield EfW (Scotland), Skelton Grange EfW (Yorkshire), Kelvin EfW (Midlands), and Protos (EfW), bringing the total projects closed to 34 since 2015 and the total to 62 since 2002. We are still seeing a lot of waste development activity across the UK and expect to support more clients in their waste projects over the next few years.

Commenting, partner Nick Stalbow said:

“The capacity gap is closing to different degrees across the UK, but there is still significant EfW development activity with numerous consented schemes looking to reach financial close with commitments from the merchant waste sector. This is a rapidly changing market with European EPC contractors, waste aggregators, and regional waste companies playing a bigger role. In parallel, we are seeing significant investment from funds into operational assets.

Ashurst’s waste team has been at the forefront of this transition from PPP to merchant projects, advising on the bank-funded projects such as Kemsley, Rookery, Earls Gate, Newhurst, Protos, Skelton Grange, Kelvin and Westfield, as well as on the projects funded by infrastructure funds, such as Doveryard, Slough, Lostock, Hooton Park, Newport, Bridgwater, Hoddesdon and Drakelow. Alongside project development, we have recently advised on a number of the waste M&A transactions and refinancings. Ashurst is proud to have a dedicated waste team that has been active in this sector since 2000, with an unrivalled record of helping projects to reach financial close, and deals to reach completion, across the key waste technologies: EfW (waste/biomass), CHP, gasification, and AD.”

Partner Cameron Smith added:

“The next couple of years will be an interesting period of transition in the global EfW space.

For example, the UK Government has recently announced how it will provide support for Carbon Capture and Storage (CCUS) technology in the context of energy from waste projects and this CCUS programme is now being rolled out – only time will tell if this leads to a material transformation in the way that EfW plants deal with their emissions and whether these facilities fall within the ambit of the UK Emissions Trading Scheme.

We are also seeing a significant change in the way that waste as a resource is being managed, with smaller scale gasification plants and emerging technologies being used to produce biogas and biofuels, transitioning away from large scale EfW facilities.

Being at the forefront of the waste market gives us great visibility of these changes and how the market is adapting accordingly.”

Partner Anthony Johnson further added:

“As well as the shift from tier 1 waste suppliers to waste aggregators and regional players, we have seen some interesting developments in the UK in terms of the approach taken to de-risking fluctuating power prices, with power income remaining a key revenue source for EfW and gasification projects. One way that this has been achieved is for projects to take advantage of private wire or corporate PPA opportunities, which in most cases offer fixed pricing for generators at levels above wholesale power prices. Physical or financial power hedging (i.e. forward selling power at a fixed price) has become another attractive option for EfW/gasification projects, and mechanisms enabling power hedging are now commonplace in standard form PPAs with licenced electricity suppliers.

Finally, following a long period during which CfD subsidy support has not been available for EfW (with CHP) technologies, the Government has recently announced its intention to reintroduce such support in the 2021/22 CfD allocation round. While the Government expects that CfDs will be offered to EfW (CHP) and other “more established” technologies at strike prices below the average expected wholesale price for electricity, a revenue stabilising mechanism like the CfD may be a welcome addition to EfW/gasification projects that are currently in development in light of the record low (and in some periods, negative) wholesale power prices that we have seen during the COVID-19 pandemic.”

A summary of The UK Government’s CCUS Update For EfW Projects, including the key milestones, can be found in our publication here.

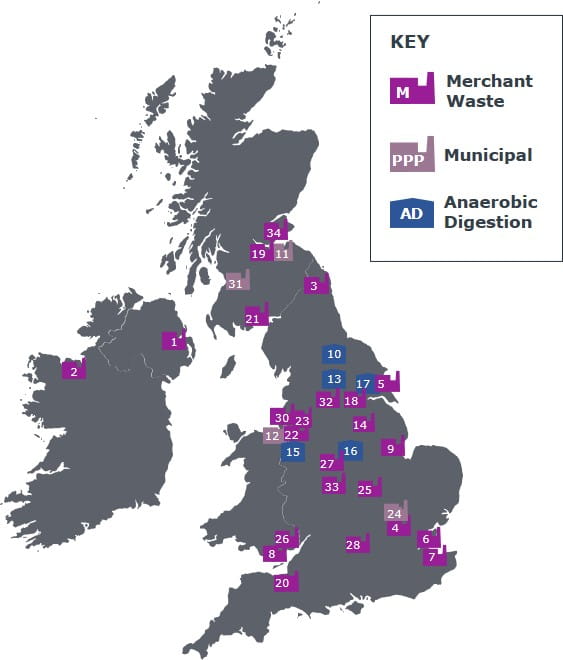

Project overview

| 1. Belfast Waste Gasification 2. Mayo/Killala Biomass 3. Cramlington Biomass CHP 4. Hoddesdon Waste Gasification 5. Hull Biomass Gasification 6. Tilbury Biomass EfW 7. Kemsley Waste CHP 8. Barry Biomass Gasification 9. Boston Biomass Gasification 10. Leeming Waste AD Gas to Grid 11. Edinburgh & Midlothian Waste EfW PPP 12. North Wales Waste EfW PPP 13. New Mill Farm AD 14. Newark Biomass CHP 15. Whitchurch Biogas AD 16. Stud Farm AD 17. Brocklesby Biogas AD | 18. Ferrybridge 2 EfW 19. Earls Gate EfW CHP 20. Bridgwater EfW 21. Crofthead AD Gas to Grid 22. Hooton Park Gasification 23. Lostock EfW 24. Rookery EfW 25. Newhurst EfW 26. Newport EfW 27. Drakelow Gasification 28. Slough EfW 29. Kwinana EfW (Australia, not shown on map) 30. Protos EfW 31. Doveryard EfW 32. Skelton Grange EfW 33. Kelvin EfW 34. Westfield EfW |