Key points:

- Australia exported AU$4.1 billion worth of sheepmeat in 2019

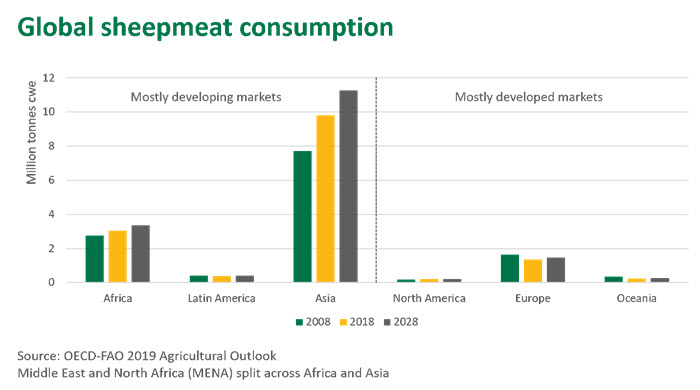

- Global sheepmeat consumption is forecast to continue growing, led by developing nations

- The MLA Global sheepmeat snapshot has been refreshed, which provides insights into global opportunities and concerns facing sheepmeat.

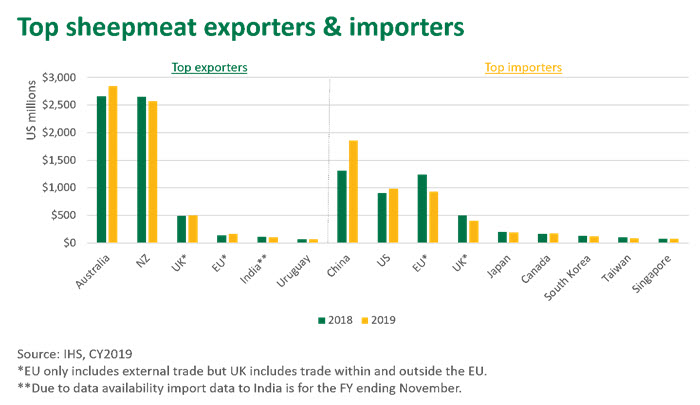

Australia was the world’s largest exporter of sheepmeat in 2019, exporting 465,000 tonnes swt of sheepmeat worth US$2.85 billion dollars (AU$4.1 billion). China remains the top destination for Australian sheepmeat, and last year grew a staggering 42% on 2018 to reach a total of 153,000 tonnes swt. Exports to the US were 76,000 tonnes swt, up 2% year-on-year.

The outlook for sheepmeat consumption is largely positive, underpinned by the growing number of affluent consumers, population expansion and escalating international demand. The price of lamb and mutton has risen in the last year, as a consequence of tightening supply combined with this strong international demand, driven by the Chinese market as its domestic pork production dropped dramatically as a result of African Swine Fever (ASF). Australia’s domestic supply is forecast to tighten again in 2020 and, combined with a soft Australian dollar, will continue to underpin the value of Australian sheepmeat exports.

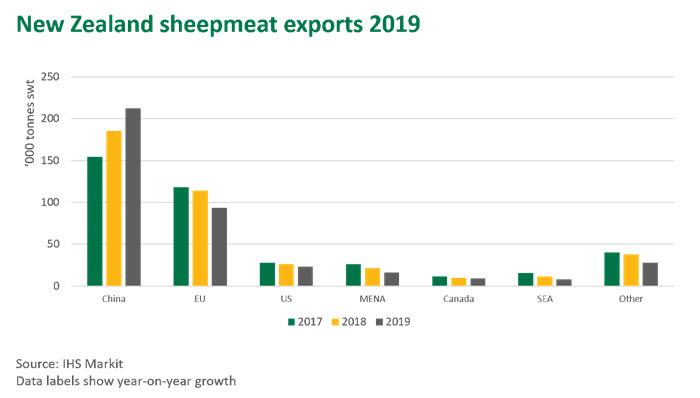

New Zealand is Australia’s main competitor on the global export market, particularly when it comes to high quality lamb. However, as a result of a widespread shift to dairy in recent years, sheepmeat production in New Zealand has fallen due to a decline in the national flock. This contraction in supply has been offset by a reduction in domestic consumption, while exports have for the most part been maintained.

New Zealand sheepmeat exports for 2019 were 390,000 tonnes swt, down 4.2 % on 2018, and valued at US$2.58 billion (A$3.7 billion). Interestingly, New Zealand sends a very high proportion of their sheepmeat to China – 54% in 2019, up from 46% in 2018. The EU is another critical market for New Zealand, with preferential market access providing a key competitive advantage over Australia. Of the 228,389 tonne quota (with zero duty), New Zealand sent 93,000 tonnes in 2019, dwarfing Australia’s quota of 19,186 tonnes. An out of quota tariff very much prohibits Australia from any further trade with the EU.

Updated global snapshot

MLA has recently released an updated Global sheepmeat snapshot, which expands upon the topics discussed above. It aims to not only provide information on what is currently driving red meat exports, but also to offer insights regarding the emerging consumer and industry trends that will influence Australia’s future exports into the global market.

The report offers discussion and illustrations on the following key topics:

- emerging opportunities and challenges for Australian sheepmeat exports

- consumption and supply insights as well as likely future trends

- comprehensive export, production and consumption statistics for Australia and key competitors.

With Australian production and exports expected to tighten considerably through 2020, understanding how to communicate value to consumers effectively will be an essential aspect of remaining globally competitive.

For detailed insights into each of our key export markets, MLA also publishes market specific snapshots.

© Meat & Livestock Australia Limited, 2020

To build your own custom report with MLA’s market information tool click here.

To view the specification of the indicators reported by MLA’s National Livestock Reporting Service click here.