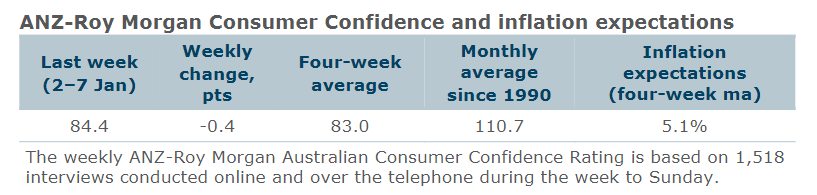

Consumer confidence fell by 0.4 points last week, but the four-week moving average rose 2.0 points.

Among the mainland states, confidence rose in South Australia and Western Australia but fell in New South Wales, Victoria and Queensland.

The four-week average of confidence moved up for all the mainland states.

‘Weekly inflation expectations’ slipped 0.2 percentage points to 5.0 per cent, while the four-week moving average dropped from 5.3 per cent to 5.1 per cent.

Three of the five subindices increased. ‘Current financial conditions’ increased 2.6 points while ‘future financial conditions’ rose 1.4 points.

‘Current economic conditions’ lifted 0.8 points. ‘Future economic conditions’ dropped 3.6 points after a jump of 4.9 points in the previous week.

The ‘time to buy a major household item’ subindex fell 3.0 points after an increase of 8.7 points in the previous week.

“The ANZ-Roy Morgan Australian Consumer Confidence retained most of its start-of-January boost, falling just 0.4 points in the week and staying higher than any result between February and December 2023,” ANZ Senior Economist Adelaide Timbrell said.

“Confidence about financial conditions and current economic conditions rose, while future economic conditions confidence scaled back after a jump last week.

“Outright and indebted homeowner confidence is still trending up sharply while renter confidence trends sideways. Rising housing prices may be behind this; we expect capital city housing prices to rise 6.0 per cent through 2024.

“We expect inflation to reduce to just 3.2 per cent year on year by the end of the year, which will help confidence across all cohorts.”