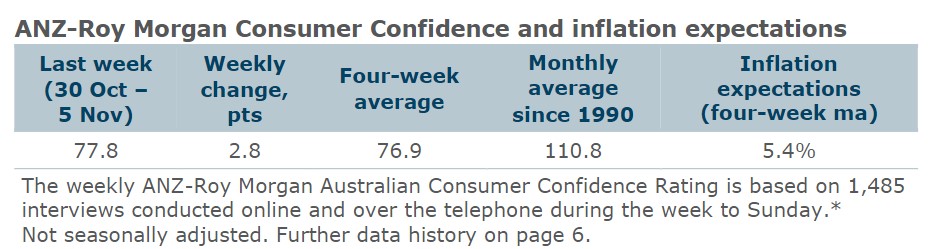

Consumer confidence increased 2.8pts, but the four-week moving average decreased 0.6pts.

Among the mainland states, confidence rose in NSW, Victoria, Queensland, and SA, while it fell slightly in WA.

‘Weekly inflation expectations’ rose 0.3ppt to 5.5%, while the four-week moving average increased from 5.3% to 5.4%.

‘Current financial conditions’ gained 6.5pts after a cumulative 11pts decline over the previous three weeks. ‘Future financial conditions’ rose 0.2pts.

‘Current economic conditions’ increased 1.9pts, while ‘future economic conditions’ softened 0.8pts.

The ‘time to buy a major household item’ subindex jumped 6pts to its highest since early February.

ANZ Senior Economist Adelaide Timbrell said: “The ANZ-Roy Morgan Australian Consumer Confidence index increased last week despite an expected cash rate hike at the November RBA board meeting. The four-week average for consumer confidence is at its weakest since late August. Household inflation expectations rose to 5.5% with petrol prices stuck at an elevated level, though overall inflation expectations seem to remain anchored.

Confidence is still stuck at very weak levels as high inflation and increased interest payments erode households’ ability to save and spend. Confidence is still lowest among those paying off their homes, and the gap slightly widened this week as renter and outright owner confidence rose, while confidence among those paying off their homes fell.”