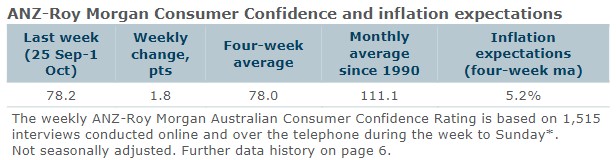

Consumer confidence rose 1.8pts, and the four-week moving average declined 0.1pts.

Confidence rose in all states and territories other than Queensland and the ACT.

‘Weekly inflation expectations’ softened 0.2ppt to 5.2%, while the four-week moving average was unchanged at 5.2%.

‘Current financial conditions’ were up 3.2pts and ‘Future financial conditions’ increased 2.4pts.

‘Current economic conditions’ decreased by 0.6pts, while ‘Future economic conditions’ rose 3.2pts.

The ‘Time to buy a major household item’ subindex improved 0.3pts.

ANZ Senior Economist Adelaide Timbrell said: “ANZ-Roy Morgan Consumer Confidence improved in the last week of September driven by improvements in financial conditions confidence. The four week average of inflation expectations went sideways despite media coverage of the August monthly CPI indicator (5.2% y/y), which suggests a touch of upside risk to the inflation outlook.

“The gap in confidence between outright homeowners and those paying off their home remains wide, though indebted homeowner confidence is rising, while outright home owner and renter confidence are trending down. Current finances confidence (which refers to current finances compared to a year ago) was at a five-month high.”