The Financial Markets Authority (FMA) – Te Mana Tātai Hokohoko – has found audit firms continue to improve the quality of their audits of FMC reporting entities.

The FMA’s Audit Quality Monitoring Report for 2022/23, released today, says audit firms have implemented improvement measures since prior reviews but audit quality remains mixed and inconsistent between firms, and in some instances between audits within the same audit firm.

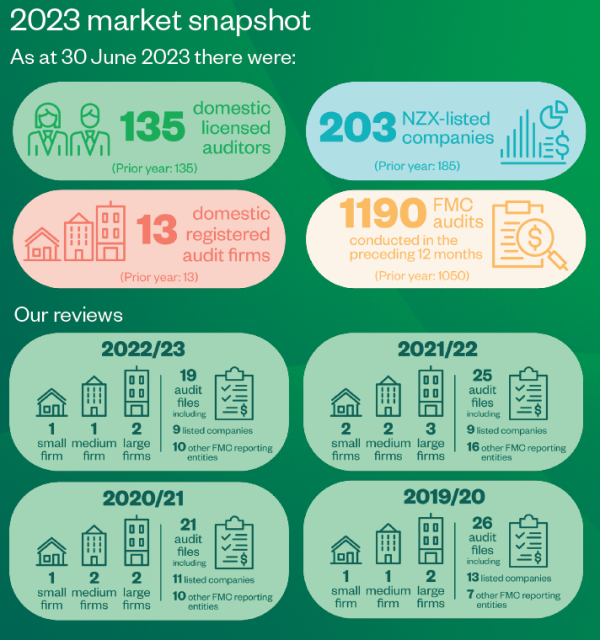

This review was part of the FMA’s last three-year monitoring cycle of all licensed auditors, which scrutinises selected audit files for listed companies and other entities that report under the Financial Markets Conduct Act (FMC Act). The FMA targets a sample of higher risk files, while others are randomly selected.

This year marked the return of onsite visits for the FMA following two years of remote reviews due to Covid-19. The FMA reviewed two large, one medium and one small audit firms. The FMA reviewed 19 audit files, of which nine were of listed entities.

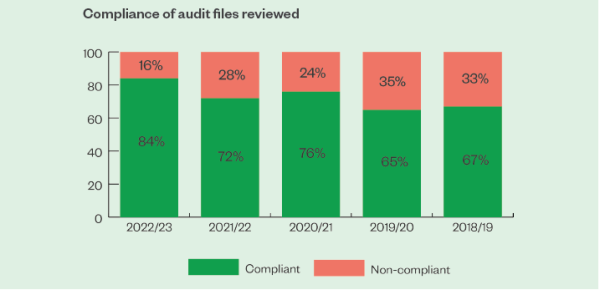

Although difficult to compare previous years, the FMA is encouraged by the percentage of ‘non-compliant’ audit files that decreased to 16% in the 2022/23 from 28% percent in 2021/22.

The FMA has highlighted the following areas for audit firms to focus on:

- Testing information prepared by management for accuracy and completeness

- Duties of an engagement quality reviewer and the process to be followed in finalising the audit

- Audit procedures and obtaining evidence in assessing going concern

- Risk assessment procedures

- Journal entry testing.

FMA Head of Audit, Financial Reporting and Climate Related Disclosures Jacco Moison said: “We are pleased to see audit firms continuously improving, with our feedback from prior reviews being incorporated into policies and procedures. With the development of new technology and the economy facing a number of risks, it is important that auditors remain alert and sceptical about the audit evidence they receive. While the improvements noted this year are welcome, we want to avoid the risk of complacency in the audit process, and its governance.”

Ethics in the audit profession

While the FMA did not observe any breaches of ethical standards during this review, it has reiterated the FMA’s expectations of audit firms following recent events overseas.

Conduct such as the exam cheating by various big four firms in many jurisdictions and the confidentiality breaches by PwC Australia raise questions about ethical behaviour across the audit profession.

Unethical conduct, by a firm or an individual auditor, can strain relationships and damage the reputation of the audit firm, but can also have a wider impact on trust in the profession and confidence in the financial services sector generally. The risk of reputational damage and harm from negative headlines is elevated for professions such as auditing that promote ethical standards in the work and services they provide.

Mr Moison said: “The conduct of those who provide financial services, including auditors, affects the consumers of those services, which is all New Zealanders. High standards of conduct support fair, efficient and transparent markets – and the confident participation in those markets of businesses, investors and consumers.

“We expect audit firms to proactively maintain a culture that enables staff at all levels to speak out on ethical issues and know such concerns will be treated seriously. Audit quality is built on independence and ethics, and those critical foundations must be maintained.”

Download the Audit Quality Monitoring Report, PDF

Audit Quality Monitoring Reports Archive