CBA Chief Economist says there are signs the consumer ‘wealth effect’ is starting to re-emerge, albeit with flat retail spending intentions in December.

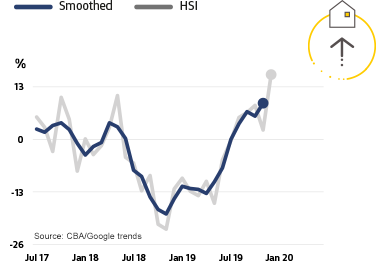

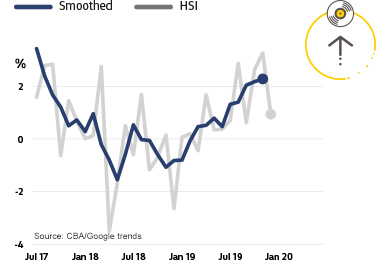

The latest monthly data from the Commonwealth Bank Household Spending Intentions (HSI) series indicates that home buying spending intentions are running at a record rate with early signs suggesting a positive wealth effect is starting to re-emerge.

CBA Chief Economist Michael Blythe says the data to the end of December confirms that the trends of recent months remained in place at the end of 2019.

“The home buying intentions series lifted again and is now at a record high. There are some early signs of a ‘wealth effect’ from the housing market supporting spending on motor vehicles, albeit from a very low level, as well as travel and entertainment,” said Mr Blythe.

Mr Blythe says the home buying HSI readings mean the pick up in dwelling prices in the second half of 2019 will continue into the first half of this year, and the residential construction downturn should be approaching bottom. “Past cycles show that leading indicators like building approvals turn about three month after home buying intentions start to lift. A bottoming in the construction cycle would remove a major growth drag on the economy, and also helps retailing.”

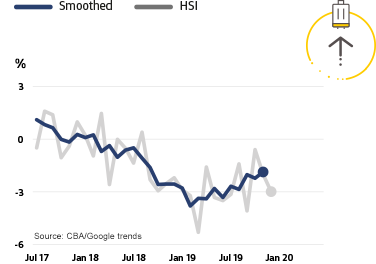

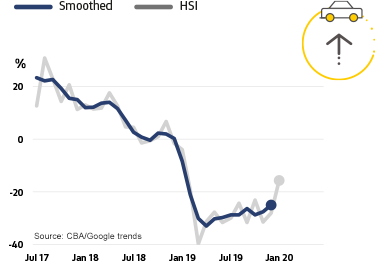

Buying intentions for motor vehicles remain soft overall in December, but the slow improvement evident in recent months accelerated sharply on the latest readings. “This outcome is significant because RBA research has revealed that the form of spending most sensitive to changes in wealth is motor vehicles,” said Mr Blythe.

“A positive wealth effect could help other forms of spending as well,” Mr Blythe added. In December, travel spending intentions continue to trend higher and entertainment spending intentions are improving at a respectable pace.

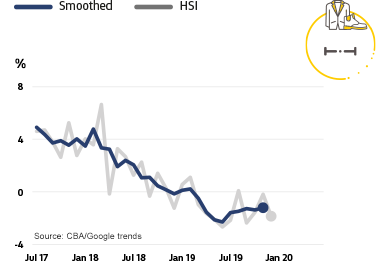

However the retail HSI was down in December, with households remaining very cautious about spending at the retail level.

“The flat trend in the retail HSI remains a disappointing outcome relative to the stimulus applied via interest rate cuts, tax rebates and the upturn in dwelling prices. The zig-zag pattern for the retail HSI indicates that the ‘Black Friday’ event brought forward spending from December into November without necessarily boosting spending overall,” Mr Blythe said.

The HSI series offers a forward-looking view by analysing actual customer behaviour from CBA’s transactions data, along with household spending intentions from Google Trends searches. This combination adds to insights on prospective household spending trends in the Australian economy.

Household Spending Intentions

CBA obtains an early indication of spending trends across seven key household sectors in Australia. Apart from home buying, the series covers around 55 per cent of Australia’s total consumer spend across; retail, travel, education, entertainment, motor vehicles, and health and fitness.

| Retail Spending Intentions |

|

| Travel Spending Intentions |

|

| Home Buying Spending Intentions |

|

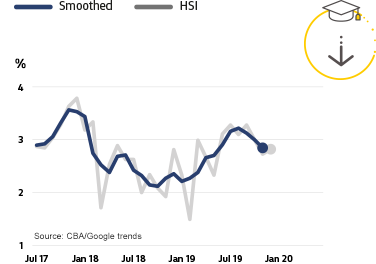

| Education Spending Intentions |

|

| Entertainment Spending Intentions |

|

| Motor Vehicles Spending Intentions |

|

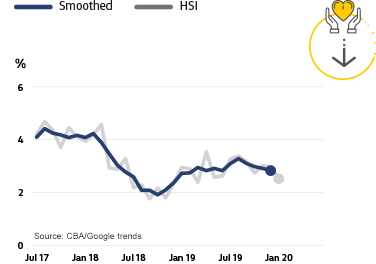

| Health & Fitness Spending Intentions |

|