Westpac New Zealand (Westpac NZ)[i] has reported an 8% fall in pre-provision profit for the six months ended 31 March 2024 compared to the same period last year, as it continues to invest in supporting customers through a challenging period and making banking simpler and safer.

Net operating income was 1% higher than the prior corresponding period, but this was more than offset by increased expenses, due to continued investment in staff and technology and a range of inflationary pressures.

Net profit after tax was $477 million, up from $428 million on the prior corresponding period, reflecting higher impairment provisions in the prior period which included an overlay for the financial impacts of severe weather following Cyclone Gabrielle, which has since been removed.

Westpac NZ Chief Executive Catherine McGrath says the bank has invested over the period to support customers with cost of living challenges in a tough environment and strengthen its business for the future.

“We’re continuing to step up to support customers through a range of immediate challenges, as well as set them up for the longer term and improve their banking experience,” Ms McGrath says.

“Despite the recession, we’re backing customers’ growth aspirations. We’ve supported first home buyers to purchase 3,101 homes in the last six months – a 14% increase on the prior corresponding period – and we have a wide range of options in the market to help them on that journey[ii].

“We’ve lifted home lending by 3% and we’ve lifted business lending by 1% as we continue to support businesses and the economy to grow.

“We’re heading into the second half of the year with good momentum and are well positioned to support further growth as the economy recovers.”

Supporting customers in challenging times

Ms McGrath says she is optimistic the economy will start improving by the end of the year, but in the meantime many households and businesses were struggling with high interest rates and costs.

“We have been focused on early and proactive outreach, contacting more than 51,000 home loan customers who were due to re-fix at higher interest rates in the past six months, as well as more than 1,800 customers we identified as at most risk of financial stress,” Ms McGrath says.

“We know things are tough for businesses as well, especially in the retail and hospitality sector. Through our internal modelling we’ve identified those most in need of help and provided a range of support, such as help with cashflow, while our free online Westpac Smarts series continues to offer practical insights and advice.

“Overall, we have fewer customers suffering hardship than we’d expected, and most remain well-placed to manage ongoing cost pressures.”

Key financials

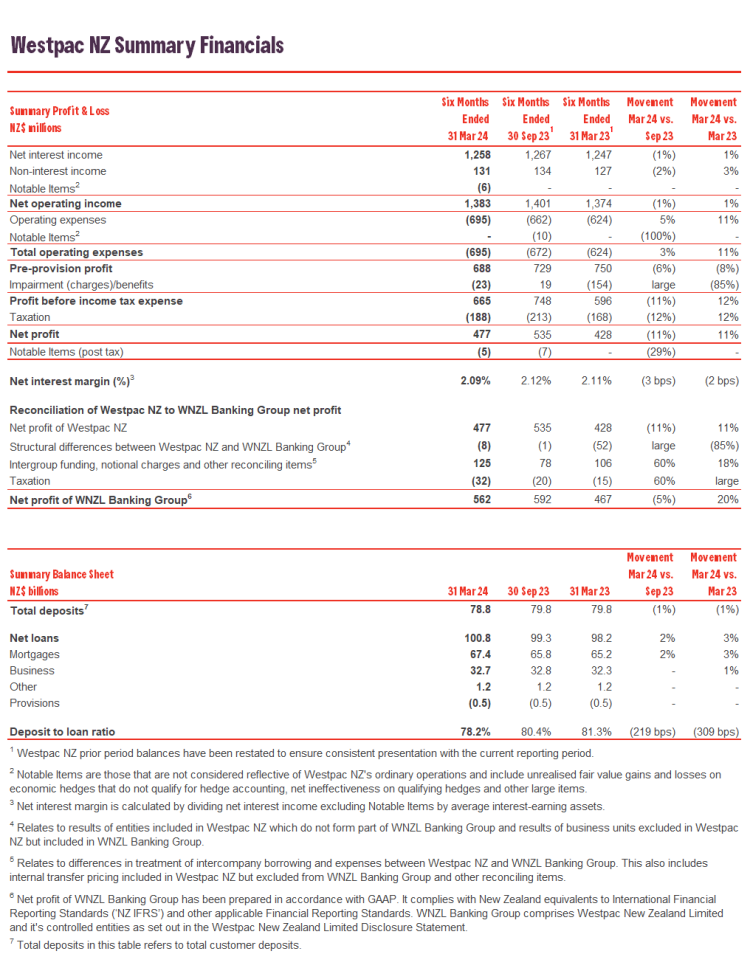

(All comparisons are for the 6 months ended 31 March 2024 versus the same period last year)

- Net profit of $477 million, up 11% (up 13% excluding Notable Items).

- Pre-provision profit of $688 million, down 8% (down 7% excluding Notable Items).

- Net operating income of $1,383 million, up 1% (up 1% excluding Notable Items).

- Operating expenses of $695 million, up 11%.

- Net impairment charge of $23 million, compared with an impairment charge of $154 million in the previous period.

- Net interest margin 2.09%, down 2 basis points excluding Notable Items.

- Home lending up 3% to $67.4 billion, Business lending up 1% to $32.7 billion, Deposits down 1% to $78.8 billion.

Combatting fraud and scams

Westpac is continuing to step up efforts to protect customers from fraud and scams. It has saved customers $41 million in fraud and scam losses in the last six months, on top of $75 million saved in the past full financial year.

“We’re doing a huge range of work to protect customers. Over the past 18 months, we’ve prevented, recovered, or reimbursed $7 of every $8 of known fraud and scams that touched our systems,” Ms McGrath says.

“We’re investing heavily to take the fight to criminals. Our enhanced fraud monitoring systems and biometric technology are preventing millions of dollars of losses, and we expect confirmation of payee technology to help when this starts rolling out later this year.

“However there are many scam cases that confirmation of payee won’t prevent. We already see customers – particularly in investment scams – tricked to knowingly put money into a different account with a different name than the ultimate destination account. We encourage customers to distrust anything they are told in relation to investment offers and to always seek independent verification.

“Banks are the last step in the chain of a successful scam. We’re calling on the other parts of that chain, such as telcos, social media platforms and tech companies, to step up and work with banks and the government to stop them at their source.

“Our data shows that most scams originate through fake social media accounts, unsolicited text messages, online searches, or search engine ads leading to fake websites and data breaches. By the time they reach the point of a funds transfer, customers have often fully bought into the scam.”

Building simpler banking experiences

Westpac continues to invest in upgrading its systems to help make banking simpler and more reliable.

“We updated our refinancing policy late last year, which removed unnecessary paperwork for home and personal loan customers looking to switch their banking to Westpac,” Ms McGrath says.

“This has helped us reduce average approval turnaround times for refinances from four days to 24 hours.”

The bank recently also brought two new mainframes online at two Auckland sites, delivering increased transaction processing capability and speed, as well as better reliability, and is bringing more tech functions in-house locally.

“Our investment in technology has contributed to a 54% decrease in higher-priority tech related incidents compared to the same period last year.”

Investing in Aotearoa

Ms McGrath said as well as helping with short-term challenges, the bank was focused on helping customers tackle longer-term challenges such as climate change in a way that enhanced their business or home environment. Actions as of 31 March 2024 included:

- Making a new sustainability learning programme available to all employees[iii].

- Lending $182 million in Greater Choices home loan top ups for a range of energy-efficient home improvements and EV purchases to more than 9,300 households since launching in 2020.

- Lending $2.4 billion in Sustainable Farm Loans since launching in June 2023.

- Lending $215 million in Sustainable Business Loans since launching in June 2023.

- Lending $21 million in EV Personal Loans, financing more than 800 EV purchases since launching in 2022.

Westpac was also focused on reducing financial exclusion so more New Zealanders could access a bank account and participate in the economy, and recently introduced changes to its bankruptcy policy[iv], an account block to help those struggling with problem gambling[v], and introduced an interpreting service[vi].

“We maintain the biggest branch presence of the big four banks and in the past six months we’ve made long-term investments in communities around the country by opening new banking centres in Porirua and Onehunga, and carrying out refurbishments and refreshments of our Hamilton, Gisborne, Manurewa, Chartwell and Albany branches,” Ms McGrath says.

Weak growth and further uncertainty ahead

Ms McGrath says a sluggish economy, weakness among key trading partners such as China and a tense geopolitical environment are all contributing to uncertainty across the economy.

“The dominant narrative right now is that economic weakness and tight financial conditions are weighing heavily on households and businesses. However, our economists see the current economic headwinds easing this year and a slow recovery taking hold, with subdued growth across the rest of this year and 2.4% GDP growth in 2025.

“The Reserve Bank has a balancing act on its hands between bringing inflation down to its 2% target while promoting economic growth.

“However a return to growth and a falling interest rate outlook should eventually deliver a much-needed shot of confidence for Kiwi families and businesses.

“When we look at some of the economic and social problems in other parts of the world, I believe Aotearoa is a great place to live and to do business. The next few months will be critical for getting businesses and communities on the same page to start unlocking our potential.”

[i] Westpac NZ is a segment of the Westpac Banking Corporation Group (Westpac Group). Westpac NZ includes, but is not limited to, Westpac New Zealand Limited, BT Funds Management (NZ) Limited and WBC (New Zealand branch). The financial results of the Westpac New Zealand Limited Banking Group (WNZL Banking Group) will be available in the Westpac New Zealand Limited Disclosure Statement, with a reconciliation between the two results also provided in the Westpac NZ Summary Financials section of this media release.

[ii] https://www.westpac.co.nz/about-us/media/innovative-home-ownership-pathways-helping-more-new-zealanders-into-their-first-home-sooner/

[iii] https://www.westpac.co.nz/about-us/media/westpac-nz-launches-sustainability-training-for-all-employees-blog-post/

[iv] https://www.westpac.co.nz/about-us/media/westpac-nz-improves-access-to-bank-accounts-for-kiwis-going-through-tough-times/

[v] https://www.westpac.co.nz/about-us/media/westpac-nz-introduces-gambling-account-block-to-support-customers/

[vi] https://www.westpac.co.nz/about-us/media/westpac-nz-launches-interpreting-service-to-support-customers/