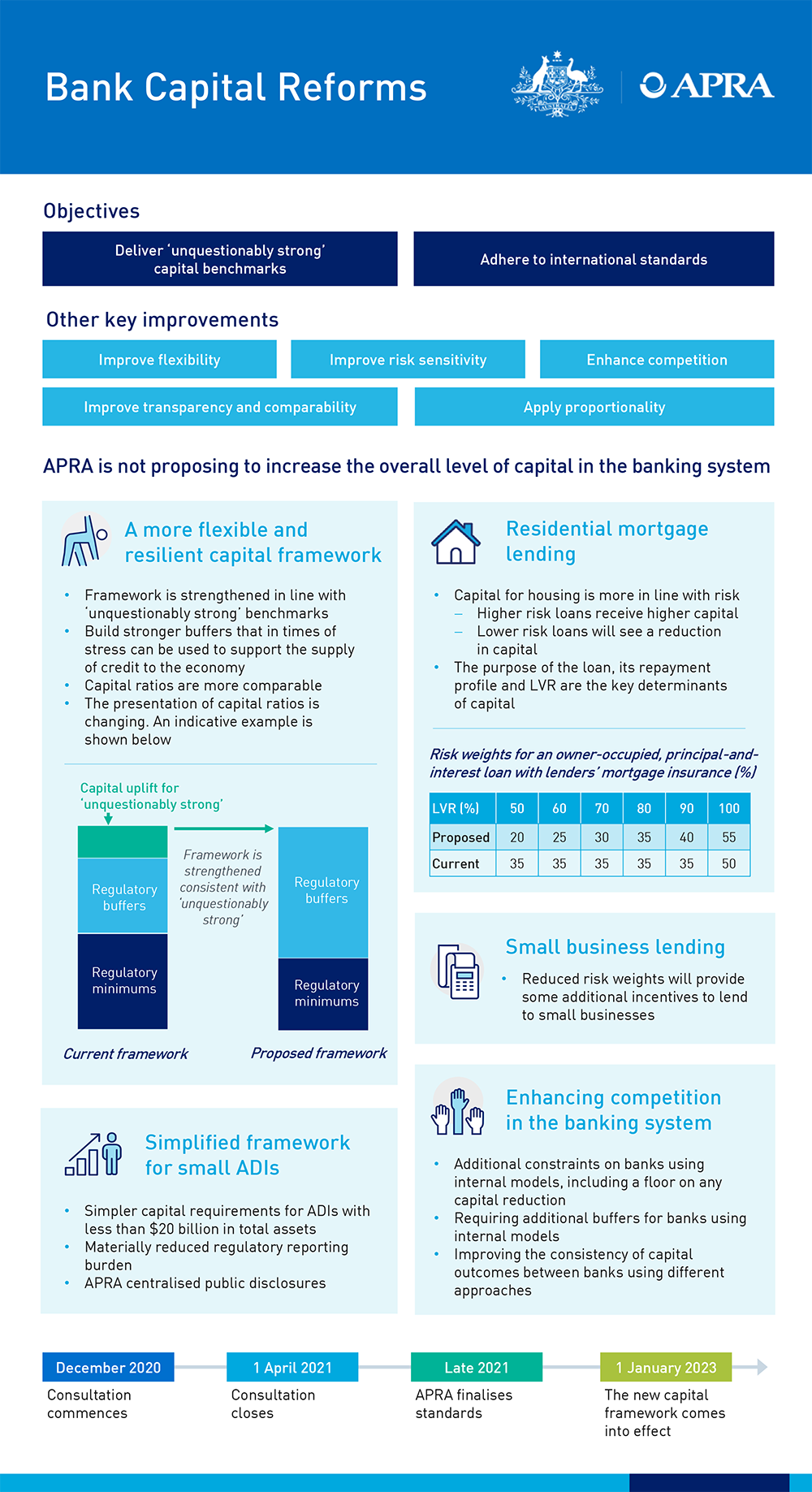

The Australian Prudential Regulation Authority (APRA) has released for consultation changes to the authorised deposit-taking institution (ADI) capital framework aimed at embedding ‘unquestionably strong’ levels of capital, improving the flexibility of the framework, and improving the transparency of ADI capital strength.

The consultation is a continuation of a process that responds to the Financial System Inquiry recommendations and ensures Australian banks meet the internationally agreed Basel III requirements.

Given the Australian banking sector is well-capitalised, the proposed changes are not expected to require ADIs to raise additional capital.

APRA’s proposed improvements to the capital framework include:

- greater risk sensitivity within the risk weighting framework, including more differentiated risk weights for different types of mortgages and reduced risk weights for small business lending;

- providing for ADIs to hold a larger share of their required capital as buffers, enhancing the ability of the framework to respond flexibly to future stress events;

- improving the transparency of the framework by requiring all ADIs to disclose their capital ratios on a common basis, and making it easier to reconcile the Australian framework with international standards; and

- introducing a simplified framework and reduced compliance requirements for smaller ADIs.

As a result of the changes, reported capital ratios will increase. Offsetting this, larger buffers will ensure the ‘unquestionably strong’ standing of the Australian banking system is not diminished.

As previously announced, the new framework is proposed to be implemented from 1 January 2023.

APRA Chair Wayne Byres said the proposed reforms would consolidate the strong capital position of Australian banks and provide further confidence in the long-term resilience of the system.

“The groundwork of previous years meant that, when COVID-19 hit, the Australian banking industry had sufficient capital depth to support customers, maintain the supply of credit and help the Australian economy on its path towards recovery.

“These proposed changes will embed the ‘unquestionably strong’ capital position that has been achieved by the banking sector into a regulatory capital framework that is more flexible and responsive at times of crisis.

“Progressing these reforms in a timely manner will deliver a robust, competitive banking system that can continue to fulfil its critical role when our community is confronted by the challenges of the future,” Mr Byres said.

The response papers, draft standards and non-confidential submissions to the previous consultations are available on the APRA website at: Revisions to the capital framework for authorised deposit-taking institutions.