Australian beef, lamb and mutton exports to China started 2019 much like they finished 2018 – running red hot. Some speculation as to the cause of this demand surge has been attributed to the rapid and widespread emergence of African Swine Fever (ASF) across China.

However, as highlighted in this separate article, growth trends were well underway before any outbreak and largely reflect growing demand from wealthy households for premium imported meat.

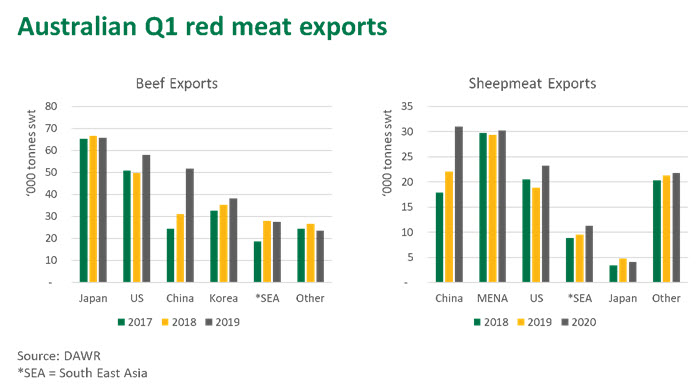

In the first three months of 2019 Australian beef exports to China were up 67% year-on-year compared to 11% across all markets.

Mutton exports were up 83%, compared to 19% across all markets and lamb exports were up 11%, against 12% across all markets.

Beef exports to China were elevated across most categories but growth was pronounced among lower-value leg cuts and manufacturing product. Knuckle exports were up 169% year-on-year, silverside up 92%, shin shank up 90% and 65CL up 50%. Mutton export growth was led by shoulder and carcase shipments.

Additional Chinese demand on the market has been well timed for Australian cattle and sheep producers who have had to destock over the past year due to drought. For instance, despite Eastern States mutton slaughter tracking 25% above year-ago levels over the first quarter, sheep prices have continued to rally in recent weeks and have breached 500¢/kg cwt. Finished cattle and cow prices have also benefitted from such demand.

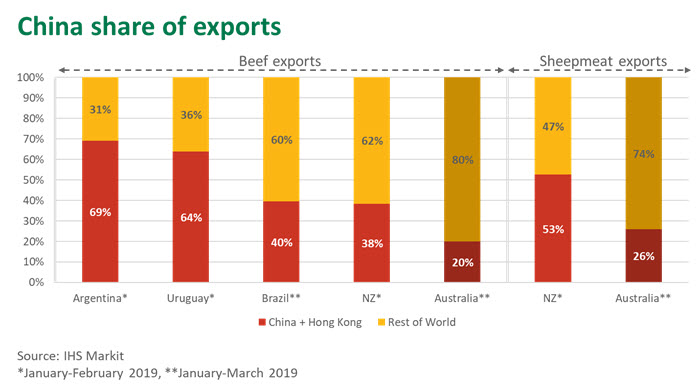

Australia is not alone in the imported China meat market, with beef in particular becoming increasingly crowded-out by product from South America. New Zealand sheepmeat has also increased its presence in the market, with exports to China over the January-February period increasing 17% year-on-year and now accounting for 53% of shipments. Fortunately, unlike other suppliers, Australia still maintains a balanced export portfolio, as highlighted below, supported by world-leading market access and a suite of recent Free Trade Agreements.

Other markets showing positive signs

While growth has been centred on China, other export markets are still performing strongly. Beef exports to the US, despite growing domestic supplies, expanded 16% over the first quarter and will remain supported as the market enters summer grilling season. Lean manufacturing beef has been particularly sought after, with import prices currently at a 3.5-year high in A$ and Australian exports of 90-95CL trim up 28% year-on-year in the first quarter. Chilled grassfed primal exports to the US also recorded a strong start to the year, up 12% year-on-year.

With the start of a new safeguard year, beef exports to Korea recorded a 14% expansion in the first quarter, with growth centred on forequarter cuts. Beef exports to Japan were steady, with grainfed supplies becoming tighter more recently, as the elevated numbers on feed at the start of the year likely worked down over the quarter.

As lamb supplies from last spring push into heavier weight ranges, lamb exports to the US, where larger cuts are preferred, have expanded 29% year-on-year in the first quarter. Lamb exports to the Middle East expanded, with growth led by Iran, but mutton shipments to the region declined in the face of stronger bidding out of China.