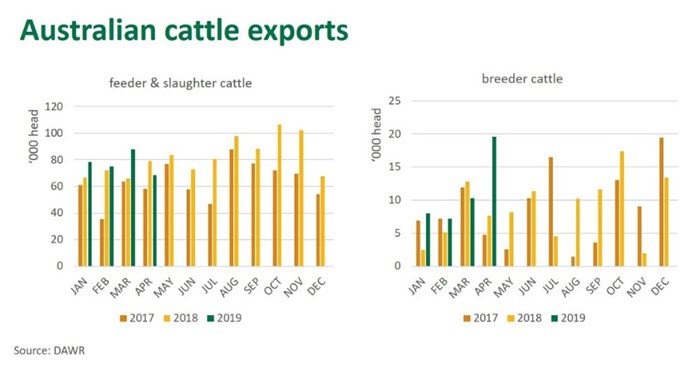

Live cattle exports have made a strong start to 2019, with total shipments up 14% year-on-year at 354,000 head. First-round musters are in full swing across northern Australia, evidenced by an increase in shipments out of Darwin in April and the seasonal return of exports out of Broome since late March. In line with an increase in supply, the price of feeder steers out of Darwin have eased in recent months, currently reported at 280-290¢/kg live weight (lwt).

Monthly feeder and slaughter cattle exports fell below year-ago levels for the first time April, however calendar year-to-April shipments were 9% higher year-on-year, at 309,000 head.

Shipments of feeder cattle to Indonesia for the calendar year-to-date totalled 181,000 head, up 23% year-on-year. A return to a more affordable price point has supported the trade to Indonesia, as has the steady supply of northern feeder cattle following a largely disappointing wet season. This, however, could limit the availability of feeder cattle as the season progresses.

In recent months, the flow of feeder cattle to Indonesia will meet rising beef demand during the Ramadhan and Eid al-Fitr period. As part of ongoing government efforts to stabilise prices in Indonesia, imported Indian buffalo meat (IBM) remains a constant throughout wet markets across Indonesia. Current wet market prices for IBM in the Greater Jakarta area range from IDR80,000-90,000/kg, while fresh beef trades at a premium from IDR110,000-115,000/kg.

Exports of feeder and slaughter cattle to Vietnam for the calendar year-to-April totalled 64,000 head, up 8% year-on-year. The limited availability of locally-sourced cattle and, in turn, higher prices has enabled Australian cattle to be more competitive in the market compared to the year prior.

Cattle exports to China for the calendar year-to-date have increased 41%, to 39,000 head. The breeder component of exports has been the stand-out, totalling 33,000 head for the calendar year-to-April and up 81% year-on-year, with a large consignment of 18,000 breeder cattle reported in April.

Exports of slaughter cattle to China continue to face numerous barriers to entry in the market and the trade for slaughter cattle is yet to expand beyond one or two shipments each month – there were no recorded shipments in April. A value-added tax on imported cattle, the 14-day imposed processing timeframe for slaughter cattle and regional limitations on sourcing cattle from Blue Tongue virus zones reflect the array of commercial challenges limiting growth in the trade. Breeder cattle exports look set to be the main component of live cattle exports to China for the remainder of the year.

Cattle exports to other markets over the year-to-April include:

- Malaysia, up 52% at 9,300 head

- Israel, up 95% at 25,000 head

- Russia, back 56% at 13,700 head