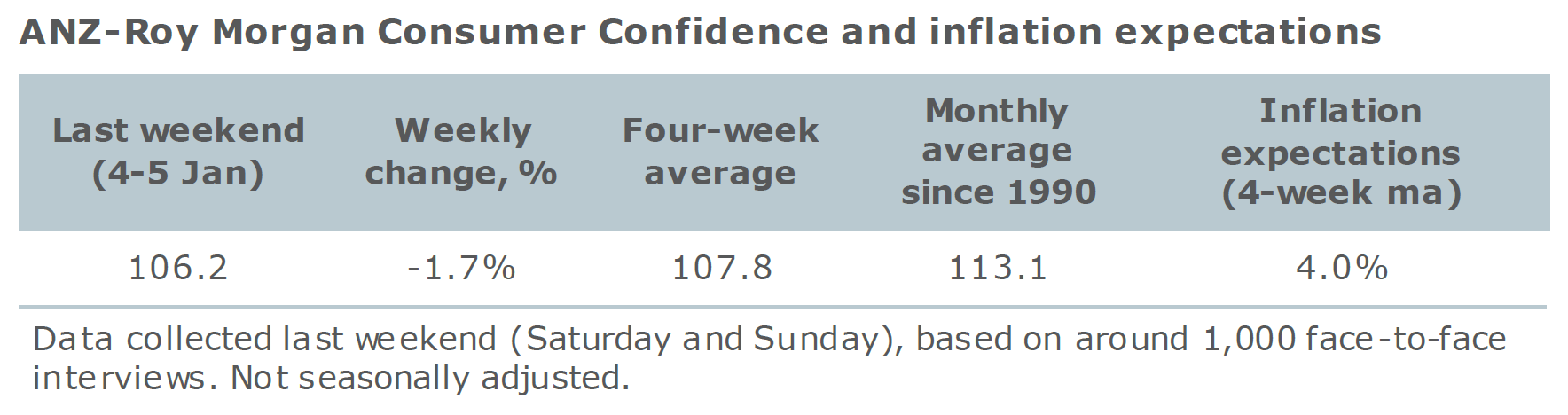

Consumer confidence fell 1.7 per cent last week to its lowest level in more than four years. A drop in confidence at the start of the year is unusual and almost certainly reflects the impact of the catastrophic bush fires over the weekend.

Consistent with this, the weakness in confidence was due to a big drop in the economic outlook, while sentiment toward personal financial circumstances actually rose.

‘Current economic conditions’ were down by a massive 12.9 per cent while ‘future economic conditions’ fell 8.1 per cent. Current economic conditions are at their lowest level since the global financial crisis, while sentiment toward the future economic outlook is at its lowest level since 1994.

In contrast, financial conditions gained. ‘Current finances’ rose 4 per cent while ‘future finances’ were up 0.3 per cent.

The ‘Time to buy a household item’ gained 4.8 per cent, recovering from a fall of 6.4 per cent seen in the last reading of the previous year. The four-week moving average of ‘inflation expectations’ was stable at 4.0 per cent, though weekly readings saw a sharp fall, which should result in a softer reading looking forward.

“Against the backdrop of the weekend’s catastrophic bush fires it is not surprising consumer confidence declined,” ANZ Head of Australian Economics David Plank said.

“But the reported decline of 1.7 per cent since the last survey in mid-December understates the weakness when one considers the New Year usually sees a strong gain in sentiment.”

“Between 2010 and 2019, the average gain in confidence for the first week of January has been 3.4 per cent. Against the usual seasonal gain of recent years, confidence has started 2020 in very poor shape and at its lowest level in more than four years.”

“The fact this is due to sharp falls in both the current and future economic outlooks indicates to us the bushfires are almost certainly the key cause.”

“In contrast, consumers’ sentiment toward their own financial circumstances has actually risen since mid-December. This offers the prospect that the impact on overall consumer confidence from the weekend’s terrible events may be relatively shortlived”.

“The policy steps taken by the federal government in recent days could contribute to that outcome. We are mindful, of course, that there is likely still bad news to come about the impact of last weekend’s fires. There is also a lot of hot and dry weather to come before the bushfire season is over.”

“The weakness in overall consumer sentiment suggests consumer caution toward spending in recent months will continue, despite the relative health of their personal financial circumstances. We expect retail sales to have rebounded modestly in November, in part due to the Black Friday sales. But the boost may be shortlived.”