Screen Australia’s 33rd annual Drama Report released today shows the second highest expenditure ever on scripted screen production in Australia, with $2.34 billion spent across a record 213 titles in 2022/23. Despite being slightly down (4%) on last year’s record expenditure, which saw $2.43 billion spent across 171 drama productions, this is significantly above the 5-year average.

Screen Australia CEO Graeme Mason said, “We’re proud to report the second highest drama spend ever in Australia. It has been remarkable witnessing the unprecedented surge in production in Australia in recent years and the 2022/23 Drama Report highlights another stellar year for drama production in Australia.”

Australian titles made up $1.13 billion of total spend. Although expenditure by Australian subscription TV and Subscription Video on Demand (SVOD) has decreased this year, growth in Free-to-Air (FTA) TV and Broadcaster Video-On-Demand (BVOD) has helped to offset those declines to deliver the second highest Australian expenditure on record. Spend on children’s drama across TV and VOD platforms also increased from last year, but has not returned to previous highs. Expenditure on Australian theatrical features declined from last year’s record high, driven by fewer big-budget titles.

“This year’s Drama Report showcases the dynamic landscape of drama, with significant expenditure coming from a number of different categories. A record Australian PDV spend and continued spend from subscription TV and SVOD titles, such as the upcoming Heartbreak High series 2, High Country and Prosper, and an increase in Australian FTA TV and BVOD spend, coming from titles such as Total Control series 3, RFDS series 2 and While the Men are Away have helped to deliver a fantastic result. We have also seen TV and VOD titles such as Neighbours exploring new hybrid distribution models, releasing on both FTA and SVOD platforms in a short window,” Mason said.

2022/23 also saw record expenditure in Australia from foreign titles ($1.22 billion, up from $904 million in 2021/22). In particular, this was driven by record expenditure from foreign titles shooting in Australia ($809 million), an increase of 83% from 2021/22 and another year of significant spend from foreign titles conducting Post, Digital and Visual effects work (PDV) in Australia.

“Big-budget foreign productions like The Fall Guy and The Kingdom of the Planet of the Apes that shoot in Australia have incredible flow-on benefits for local businesses, communities and the broader economy, and allow local cast and crew to acquire experience and new skills. Further, the international demand for our PDV expertise reflects the confidence of global companies in our talent and technology,” Mason continued.

Figure 1: Total expenditure in Australia ($m)

.jpg)

New South Wales set a new record for the third year running, with over $1.3 billion in expenditure in 2022/23, accounting for 56% of the national total. Queensland also set a new record, with total expenditure of $581 million, 23% above last year. Victoria, South Australia and Western Australia all saw declines with spend falling 45%, 52% and 9% respectively. Combined spend in the Australian Capital Territory, Northern Territory and Tasmania declined to $4 million in 2022/23.

“It’s fantastic to see New South Wales and Queensland continue to go from strength to strength. Like any industry, the demand for production and post-production services and particular filming locations, will understandably come in ebbs and flows. What’s important is these results illustrate that the states and territories are generating significant activity domestically and are establishing themselves as premier destinations for foreign projects.”

Figure 2: Spend by location ($m)

.jpg)

“There’s no denying, our screen practitioners and businesses continue to punch above their weight both domestically and on the international stage. As we look to the future, we need to ensure that we stay on top of our game – by working together with industry and the state and territory agencies to foster the skilled workforce this level of production critically needs,” Mason said.

AUSTRALIAN THEATRICAL FEATURE FILMS DECLINE FROM LAST YEAR’S RECORD

Australian theatrical features saw total expenditure of $363 million in 2022/23, a 54% decrease in spending since 2021/22, and 17% below the 5-year average. This drop can be attributed to having fewer big-budget theatrical features, with only one big-budget title in 2022/23. In contrast, the previous year’s record-high spending was driven by several big-budget features such as Furiosa, Foe, and Better Man.

2022/23 theatrical features included Limbo, The New Boy, and The Royal Hotel.

AUSTRALIAN GENERAL TV AND VOD DRAMA SEES CONTINUED HIGH EXPENDITURE OVERALL

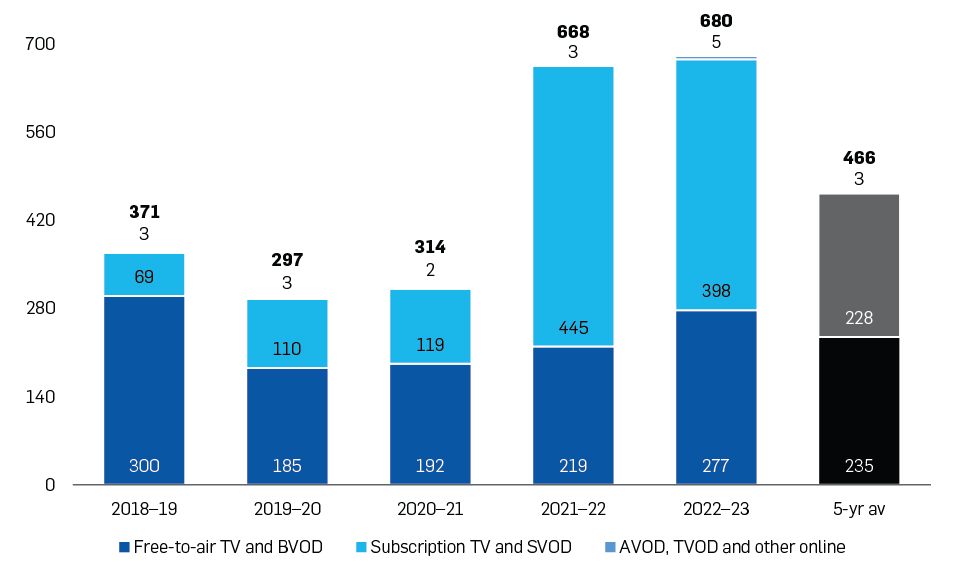

The $680 million of expenditure in 2022/23 was slightly (2%) up on last year’s result. This category is made up of three sub-categories:

Figure 14: Australia general TV and VOD drama – spend ($m)

.jpg)

AUSTRALIAN GENERAL FTA TV AND BVOD DRAMA GROWS FOR THIRD CONSECUTIVE YEAR

This segment encompasses drama content designed for family and adult audiences, initially released on FTA television channels such as ABC, NITV, SBS, Seven, Nine, and 10, or their respective online platforms like ABC iview, SBS On Demand, 7plus, 9Now, and 10 play.

Australian general FTA TV and BVOD expenditure increased by 26% in 2022/23. This growth was driven by a significant uptick in the number of titles (up by 21%), hours (up by 16%) and average cost-per-hour (up by 9%). In particular, this strong performance was driven by series and serials, such as Home and Away (Seven), Neighbours (10), In Limbo and Mother and Son (ABC).

Other titles included mini-series such as Total Control series 3 (ABC) and Paper Dolls (10), and single-episode titles such as Night Bloomers (SBS).

AUSTRALIAN GENERAL SUBSCRIPTION TV AND SVOD DRAMA EXPERIENCES ANOTHER YEAR OF HIGH SPEND

This category encompasses drama content tailored for family and adult audiences, initially released on subscription TV platforms like Foxtel, Foxtel Now, Foxtel Go, and other Foxtel services, or subscription VOD platforms including Amazon Prime, Binge, Disney+, Netflix, Paramount+, and Stan.

In 2022/23, expenditure on Australian general subscription TV and SVOD drama experienced an 11% decline from the record high of the previous year, however it remains the largest category of spend within Australian TV and VOD. The year saw a higher concentration of big-budget titles than previous years, with seven out of 21 SVOD titles having budgets in excess of $20 million, in contrast to eight out of 30 titles in 2021/22. Stan held the largest single share of total titles and total hours in this category (38% and 33%, respectively), consistent with last year’s trend.

Titles included C*A*U*G*H*T and Wolf Like Me series 2 (Stan), Heartbreak High series 2 (Netflix) and NCIS: Sydney (Paramount+).

AUSTRALIAN GENERAL AVOD, TVOD, AND ONLINE DRAMA GROWS SIGNIFICANTLY

This category includes drama content aimed at family and adult audiences, initially released on an array of free platforms like AVOD services such as Facebook, Instagram, TikTok, and YouTube, TVOD platforms like iTunes, and various emerging online services.

Australian general AVOD, TVOD and other online drama experienced significant growth across most key indicators. Spend increased by 74% since 2021/22 (from $3 million to $5 million), increasing to 61% above the 5-year average. This was driven by a doubling of the number of titles (12 to 24), and an almost tripling of hours produced (11 to 29).

Titles included Counter Girls (YouTube) and Monologue (Facebook/YouTube/Instagram).

AUSTRALIAN CHILDREN’S TV AND VOD DRAMA SEES GROWTH IN EXPENDITURE, DRIVEN BY LIVE-ACTION TITLES

Australian children’s TV and VOD expenditure reached $81 million compared to $67 million in 2021/22 and a 5-year average of $74 million. This increase in spending was primarily driven by live-action productions, including titles like Beep and Mort series 2, F.A.N.G, The PM’s Daughter series 2 (ABC), Rock Island Mysteries series 2 (10), and Surviving Summer series 2 (Netflix).

The ABC continues to commission the majority of this slate, accounting for nine out of the 12 titles that entered production, with support from Screen Australia, which contributed finance to ten titles. The Australian Children’s Television Foundation (ACTF) supported four titles.

In the last five years, the ABC’s share of all children’s TV and VOD titles has increased from 45% to 75%. The growth in the ABC’s share of titles has been driven by fewer overall children’s titles, which can be attributed to declines in the number of children’s titles commissioned by commercial FTA broadcasters.

RECORD-BREAKING YEAR FOR FOREIGN PRODUCTIONS SHOOTING IN AUSTRALIA

The record total foreign spend ($1.22 billion) in 2022/23 was driven largely by record expenditure from foreign titles shooting in Australia. These foreign shoot titles spent $809 million, an all-time record and 83% above the previous year. This record foreign shoot spend was largely accounted for by a handful of big-budget theatrical features, including The Fall Guy, Godzilla x Kong: The New Empire and Kingdom of the Planet of the Apes.

AUSTRALIA’S PDV SECTOR HIT RECORD NUMBERS

To provide a sense of the ongoing business activity of PDV companies in a given financial year, the PDV Services section of the Drama Report uses a different data timeline to the rest of the report. In this section, a project’s total PDV spend is reported as it occurs, rather than attributing the whole amount to the year in which work commenced. The data cannot be compared to results presented in other sections of the Drama Report.

Total PDV expenditure reached $714 million in 2022/23, a new record, up 21% from the previous year and 60% above the 5-year average. This can be attributed to growth in PDV spend from both Australian titles and foreign PDV-only titles. In particular, Australian titles spent $269 million on PDV, a 34% boost from the prior year and 44% above the 5-year average. Australian titles that conducted PDV work included Wolf Like Me series 2 and Boy Swallows Universe. Foreign PDV-only projects spent $407 million, a 26% increase from the previous year and 87% above the 5-year average. Foreign PDV-only titles included Ant-Man and the Wasp: Quantumania and the Magician’s Elephant. Foreign shoot titles spent $39 million on PDV, a slight dip from the previous year.

ABOUT THE DATA

The Drama Report uses data from industry to provide an overview of the production of local and foreign feature, television, VOD and children’s drama titles, as well as PDV activity. All production expenditure is allocated to the year in which principal photography began. PDV employs a secondary method of analysis, which is outlined in the PDV section below, and in the report. ‘Drama’ refers to scripted narratives of any genre. Titles in the report are categorised according to the platform they were first released on.

RESOURCES