Australian households’ spending intentions for travel, entertainment and home-buying jumped in March 2021 as the economy extended its recovery from the COVID pandemic, the Commonwealth Bank Household Spending Intentions (HSI) series showed. The March rebound also reflected the increase in spending relative to the start of the COVID-19 period in March 2020.

The stronger spending intentions data dovetails with CBA economists’ forecast for the Australian economy to reach pre-pandemic growth levels by the first quarter of 2021. CBA economists forecast GDP to expand by 4.7 per cent in 2021, while the unemployment rate is seen declining to 5.0 per cent.

“The stronger Household Spending Intentions report is another signal that Australia’s economic recovery is ongoing,” said CBA Chief Economist Stephen Halmarick.

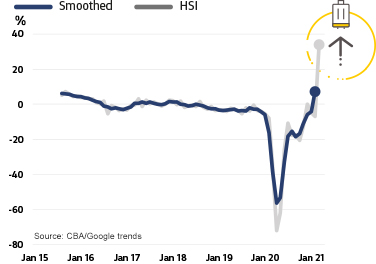

Travel spending intentions posted the strongest year-on-year improvement among all seven categories in CBA’s Household Spending Intensions series. The increase is partly driven by stronger travel-related spending and partly due to the collapse in spending recorded in March last year, Mr Halmarick said.

“The travel sector was among the hardest hit by the onset of the COVID pandemic, with border closures and a country-wide lockdown stifling nearly all travel-related activity,” Mr Halmarick said. “This month’s data, while distorted by base-effects, still demonstrates how far the sector has recovered since last year.”

For the year to March, there was a strong increase in spending intentions for destinations such as amusement parks and aquariums, as well as accommodation such as hotels, motels, resorts and motor home and RV rentals. Still, the annual pace of spending for airlines, cruise ships, timeshare, travel agents and bus lines all posted declines, indicating that the industry’s rebound remains uneven.

“A year ago bars, clubs, restaurants and movie theatres wrangled with the swiftly escalating restrictions in the lead-up to a country-wide lockdown. This March, the picture for this sector is much improved, as pent-up demand among consumers helped spur both actual and prospective spending on the category,” Mr Halmarick said.

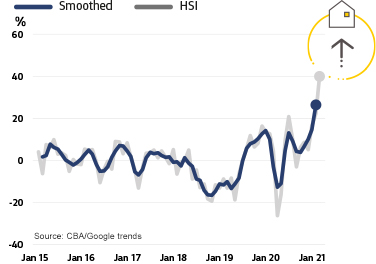

Home buying intentions set a new series high in March as both home loan applications and Google searches increased again. This month’s data also reflect the early impact of the pandemic on the nation’s property market, as restrictions and lockdowns stymied home sales in March 2020.

“We continue to see demand for residential property as a key source of support for the Australian economy in 2021,” Mr Halmarick said, adding that low interest rates were contributing to this trend.

Still, spending intentions on retail slowed versus March last year. While the retail sector had been a standout in March 2020, as actual spending and spending intensions surged during the early stages of the pandemic, retail spending and spending intentions growth had stabilised in recent months.

“Retail sales were the outperformer last year as everybody rushed to the shops to buy their canned goods and toilet paper, so the comparisons to last year underplay the strength of the sector and the continued economic rebound,” Mr Halmarick said.

The HSI series offers a forward-looking view by analysing actual customer behaviour from CBA’s transactions data, along with household spending search activity from Google Trends. This combination adds to insights on prospective household spending trends in the Australian economy.

Entertainment spending intensions were also sharply higher in March, as the base-effect highlighted the stark difference in the sector’s outlook when compared to last year.

Monthly Household Spending Intentions – March 2021

Each month, analysis by CBA’s Global Economic and Markets Research team provides an early indication of spending trends across seven key household sectors in Australia. In addition to home buying, the series covers around 55 per cent of Australia’s total consumer spend across; retail, travel, education, entertainment, motor vehicles, and health and fitness.

Home Buying Intentions

- Home buying spending intentions increased in March to a new series-high. While part of the strength reflects the declines seen at the start of the Covid-19 period last year, the strong increase in March reflects both an increase in home loan applications and Google searches.

- We continue to expect the home buying market to be a key source of support for the Australian economy in 2021 – driven largely by the very low level of interest rates.

- As we stated in last month’s HSI report, residential property prices in Australia are expected to be up 8% in 2021 and 6% in 2022, with house prices expected to be 9% higher this year.

Retail Spending Intentions

- The pace of Retail spending intentions declined in March 2021 – reflecting the jump in retail sales at the start of the Covid-19 lockdowns one year ago.

- The year to March 2021 saw a wide range of spending patterns across different sectors of the market. Relative to March last year, strong increases were seen in spending on clothing & footwear, department stores, furniture and home equipment stores, hardware stores, jewellery & watch stores, luggage & leather goods, beauty stores & barbers, cosmetic stores, health spas, digital apps, electronic stores and florists.

- Some major categories, however, saw declines in the year to March, including: grocery stores & supermarkets, duty free stores, pharmacies and stationary & office supplies.

Travel Spending Intentions

- Travel spending intentions jumped higher in March, partly due to the start of the collapse seen last year, but also due to an increase in travel related spending in the month.

- For the year to March, spending intentions increased noticeably for; amusement parks, aquariums, camper & recreation vehicle dealers, hotels, motels & resorts, motor home and RV rentals, sport & rec camps, tourist attractions, trailer park & camp grounds and car rentals.

- Declines were seen in the annual pace of spending for airlines, cruise ships, timeshare, travel agents and bus lines.

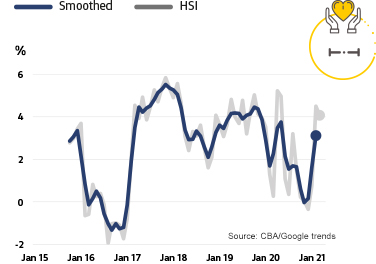

Health & Fitness Spending Intentions

- Health & fitness spending intentions were largely unchanged in March, consolidating the gains seen since the end of 2020. While actual spending continued to rise, Google searches were down.

- Health & fitness spending intentions were very volatile through 2020 as the impact of Covid-19 and the various lock-downs across the states had a significant impact. This volatility will now likely be reflected in the annual changes throughout 2021.

- For March 2021 the largest annual increases in spending were seen for; sports clothing, chiropractors, dentists, doctors, hospitals, nursing and personal care, optometrists, podiatrists, bicycle shops, professional sport, golf courses (private and public) and sporting goods stores.

Entertainment Spending Intentions

- Entertainment spending intentions were also sharply higher in March, as the base-effects from 2020 came into play and as spending increased in the month.

- Some of the biggest improvements in spending on the year for March 2021 included: on premise drinking establishments, restaurants, fast food outlets, boat rentals, bowling alleys, cable TV, movie theatres, dance halls, studios & schools, digital books, movies & music and musical theatre venues.

- In contrast, some weakness is evident in spending in off-premise alcohol, digital games and video game supplies and establishments.

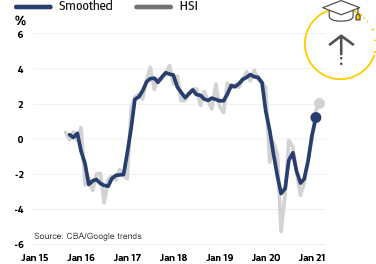

Education Spending Intentions

- Education spending intentions continued their recovery in March, with the number of transactions improving even while Google searches and the value of transactions declined.

- In terms of transaction volume, increases were seen in the year to March for colleges & universities, secondary schools and trade & vocational schools.

- In terms of transaction values, increases in the year to March were seen in correspondence schools, secondary schools and trade & vocational schools. This was offset by declines in business & secretarial schools and colleges & universities.

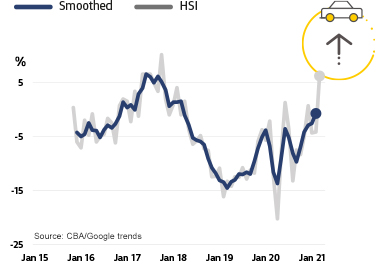

Motor Vehicle Spending Intentions

- Motor vehicle spending jumped higher in March. While Google searches were little changed, motor vehicle purchases and motor vehicle loan applications both increased in March 2021 and relative to March 2020.

- The changing use of public transport, supply shortages and changing patterns of work are all supporting an improvement in motor vehicle spending intentions.

- The ongoing improvement in the housing market is also expected to support the outlook for motor vehicle spending – as increased household wealth can translate into increased demand for a new or used cars.