There have been changes to the Fair Work Act as part of the new ‘Closing Loopholes’ laws.

This page provides detailed information about the changes.

Key points

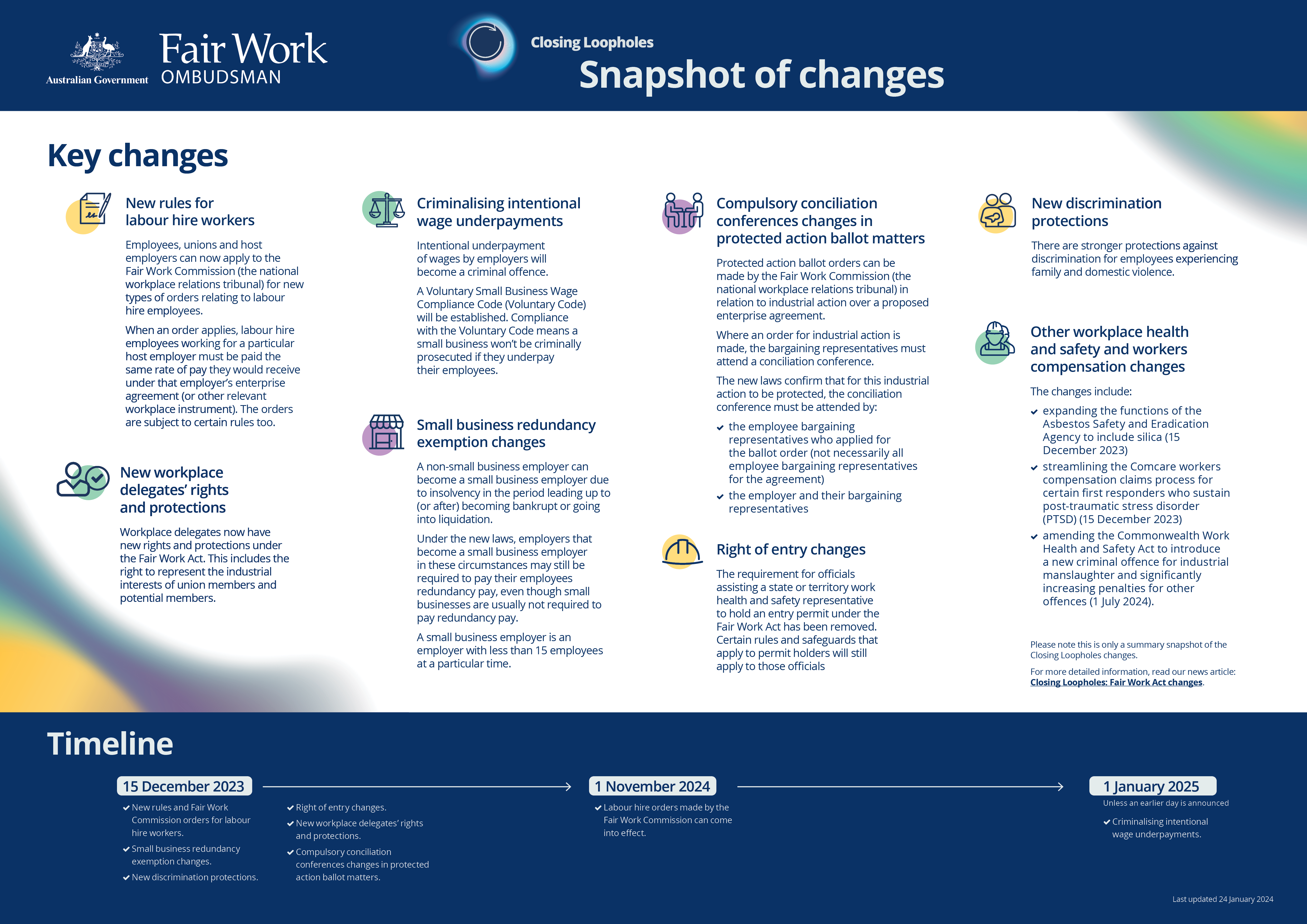

- The Australian Government has passed new workplace laws as part of its ‘Closing Loopholes’ legislation.

- Employers, employees and others should stay across these changes as they may impact their workplace.

- The changes take effect at different times between now and 2025.

- Some changes affect the work we (the Fair Work Ombudsman) do.

- Other changes will affect the work of the Fair Work Commission (the Commission). The Commission is the national workplace relations tribunal and registered organisations regulator.

- We are currently reviewing our information, tools and resources and are preparing updates.

- To stay updated, subscribe to email updates. We’ll email you as changes take effect and we have published updated information.

Tip: Read our key words list

We cover some new and complex words in this news article. Check out the Key words list for definitions of these words.

Major changes

The major workplace changes relate to:

- rules for labour hire workers

- criminalising intentional wage underpayments

- new discrimination protections

- small business redundancy exemptions

- workplace delegates’ rights

- right of entry

- compulsory conciliation conferences in protected action ballot matters.

Rules for labour hire workers

This change started on 15 December 2023.

Some anti-avoidance provisions applied from 4 September 2023.

Any orders made by the Commission won’t come into effect until at least 1 November 2024.

Employees, unions and host employers can now apply to the Commission for new types of orders relating to labour hire employees.

When one of these types of orders applies, a labour hire employer must pay their employees supplied to a host employer at least the same rate they’d receive under the host employer’s:

- enterprise agreement, or

- other kind of workplace instrument that provides for terms and conditions of employment (for example, a public service determination).

The orders are subject to certain rules too.

Obligations of host employers

Where an order has been made, host employers must:

- notify the labour hire employers covered by the order when a new enterprise agreement has been approved that will, if it comes into operation, become the instrument covered by the order

- apply to the Commission to vary the order if they engage another labour hire employer and their employees to perform the same work as those already covered by the order

- notify potential and successful tenderers of the possible effect of the order on them.

Exceptions

The Commission can’t make an order if:

- it’s not fair and reasonable in the circumstances

- the arrangements are for a service to be provided rather than the supply of labour to a host employer

- the host employer is a small business employer.

In addition, an order won’t affect:

- employees engaged in training arrangements under state and territory laws

- certain short-term employment arrangements (usually 3 months or less).

Disputes about orders

If a dispute about an order can’t be resolved at the workplace level, a party to the dispute can apply to the Commission to resolve it.

Penalties may apply to employers that don’t comply with the new provisions. This includes new prohibitions that applied from 4 September 2023 on entering into arrangements to:

- prevent the Commission from making an order

- avoid the operation or effect of an order that has been made.

Criminalising intentional wage underpayments

These changes won’t start before 1 January 2025.

As part of these changes, intentional underpayment of wages by employers will become a criminal offence.

Employers will commit an offence if:

- they’re required to pay an amount to an employee (such as wages), or on behalf of or for the benefit of an employee (such as superannuation) under the Fair Work Act, or an industrial instrument

- they intentionally engage in conduct that results in their failure to pay those amounts to or for the employee on or before the day they’re due to be paid.

Exceptions

These provisions don’t apply to certain employees for:

- superannuation contributions

- payment for taking long service leave payments

- payment for taking leave connected with being the victim of a crime

- payment for taking jury duty leave or for emergency services duties.

These laws also don’t apply to employers who:

- unintentionally underpay their employees, or

- pay incorrect amounts by mistake.

Penalties

For a company

The following penalties will apply:

- if the court can determine the underpayment, the greater of 3 times the amount of the underpayment and $7.825 million, or

- if the court can’t determine the underpayment, $7.825 million.

For an individual

The following penalties will apply:

- maximum of 10 years in prison

- if the court can determine the underpayment, the greater of 3 times the amount of the underpayment and $1.565 million, or

- if the court can’t determine the underpayment, $1.565 million.

We (the Fair Work Ombudsman) will be responsible for investigating suspected underpayment offences.

Voluntary Small Business Wage Compliance Code

A Voluntary Small Business Wage Compliance Code (Voluntary Code) will be established.

Compliance with the Voluntary Code means a small business won’t be criminally prosecuted if they underpay their employees.

The Voluntary Code is in the process of being developed. We’ll provide more information about the Voluntary Code and how it operates when it’s available. Please keep checking back here for updates.

New discrimination protections

This change started on 15 December 2023.

There are stronger protections against discrimination for employees experiencing family and domestic violence.

This means that it’s unlawful for an employer to take adverse action (including dismissal) against an employee because the employee is (or has been) experiencing family and domestic violence.

This discrimination protection also applies to potential future employees.

Awards and enterprise agreements must also not include terms that discriminate against an employee because they’re experiencing (or have experienced) family and domestic violence.

Small business redundancy exemptions

This change started on 15 December 2023.

Small business employers aren’t usually required to pay redundancy pay to employees who are made redundant.

However, a non-small business can become a small business as part of the process of downsizing its workforce. This can be due to insolvency in the period leading up to (or after) becoming:

- bankrupt, or

- going into liquidation.

In the past, this has meant that these employers no longer need to pay redundancy pay to employees made redundant after the business has fewer than 15 employees left.

Under the new laws, non-small business employers that become a small business employer in these circumstances may still be required to pay their employees redundancy pay.

Example: Small business redundancy exemptions

Radios 4 You & Us is a medium-sized electronics retailer with 45 employees.

The business provides sales and repairs online and in a physical shop. It also provides an afterhours service to radios and speakers, music production and DJ equipment.

Due to market factors, Radios 4 You & Us becomes insolvent and goes into liquidation.

An insolvency practitioner is appointed and makes 40 employees in the repair, sales and customer service part of the business redundant due to the insolvency.

5 payroll employees remain employed to help with the winding up of Radios 4 You & Us.

3 months after the 40 employees were made redundant, Radios 4 You & Us permanently closes and the remaining 5 employees are made redundant.

Even though Radios 4 You & Us is classified as a small business now as it employed fewer than 15 people, the employees will still be entitled to redundancy pay as they would have been before the business became a small business.

The remaining employees get redundancy pay because Radios 4 You & Us:

- is in liquidation

- became a small business because it terminated the 40 employees due to the insolvency of the employer.

Workplace delegates’ rights

This change started on 15 December 2023.

Workplace delegates now have new rights and protections under the Fair Work Act.

A workplace delegate is an employee:

- appointed or elected under the rules of an employee organisation

- who represent members of the organisation in the workplace.

The changes mean that delegates are entitled to:

- represent the industrial interests of members and potential members of the employee organisation (including in disputes with their employer)

- reasonable communication with members and potential members about their industrial interests

- reasonable access to the workplace and its facilities to represent those industrial interests.

Delegates employed by non-small businesses are also entitled to have reasonable access to paid time during normal working hours for workplace delegate training.

The changes also introduce new general protections for which penalties may apply. An employer must not:

- unreasonably fail or refuse to deal with the workplace delegate

- knowingly or recklessly make a false or misleading representation to the workplace delegate, or

- unreasonably hinder, obstruct or prevent the exercise of the rights of the workplace delegate.

Example: Workplace delegates’ rights

Kieran is a workplace delegate for his union.

As a delegate, Kieran wants to run a short presentation on what workers can expect once bargaining starts for their new enterprise agreement. He also wants their input on the issues that are most important to them.

Kieran schedules a 15 minute meeting during the employees’ lunch break in the mess hall on-site.

On the day of the meeting, Kieran finds that the employer has locked the mess hall at the time of the meeting. The mess hall is normally left open during lunch.

When Kieran approaches the employer about this, his employer says he locked the mess hall. He did this because he didn’t want Kieran talking with other colleagues about bargaining while they’re at work.

The employer’s actions are a breach of the general protections for workplace delegates and are unlawful. This is because the employer has:

- unreasonably prevented Kieran from access to workplace facilities to represent the industrial interests of members

- unreasonably interfered with Kieran’s right to reasonable communication with members and other workers eligible to be members in relation to their industrial interests

The employer may also have breached an award or agreement term that provides for the exercise of workplace delegates’ rights.

Awards and new enterprise agreements

From 1 July 2024, the following must have a term providing for the exercise of rights of workplace delegates:

- awards

- new enterprise agreements voted on after that date

- new workplace determinations.

Right of entry

This change started on 15 December 2023.

The requirement for officials assisting a state or territory work health and safety representative to hold an entry permit under the Fair Work Act has been removed.

This change will be reviewed 9 months after it starts.

Compulsory conciliation conferences in protected action ballot matters

This change started on 15 December 2023.

A protected action ballot is a secret vote by eligible employees on whether they want to take industrial action for a proposed enterprise agreement.

Where the Commission has made a protected action ballot order in relation to a proposed enterprise agreement, they’re required to make an order directing all bargaining representatives for the proposed agreement to attend a mediation or conciliation conference.

This change means that for the subsequent employee claim action or employer response action to be protected, the following must have attended the mediation and conciliation conference:

- the employee bargaining representatives who applied for a protected action ballot order (not necessarily all employee bargaining representatives for the agreement)

- the employer and any bargaining representative of the employer.

Changes to workplace health and safety and workers compensation

There are other workplace changes as part of the Closing Loopholes laws. These include changes to workers compensation and workplace health and safety.

The changes include:

- 15 December 2023: expanding the functions of the Asbestos Safety and Eradication Agency to include silica

- 15 December 2023: streamlining the Comcare workers compensation claims process for certain first responders who sustain post-traumatic stress disorder (PTSD)

- 14 June 2024: introducing a new guide for arranging rehabilitation assessments and requiring examinations to be prepared by Comcare

- 1 July 2024: amending the Commonwealth Work Health and Safety Act to introduce a new criminal offence for industrial manslaughter and significantly increasing penalties for other offences.

Other government bodies will be responsible for communicating about these changes, including Comcare and Safe Work Australia.

Keep up to date

We’ll continue to update our website as more information is available and as changes come into effect.

To stay up to date, subscribe to email updates. It only takes a few moments to sign up and will help you stay in the loop with changes to workplace laws.

You can also follow us on social media for updates:

Key words

Below are definitions of key words used in this news article:

| Word | Definition |

|---|---|

| adverse action | Action taken by an employer, employee, contractor or industrial association, which may be unlawful depending on the reason for the action. For example, dismissing an employee for taking industrial action. |

| Closing Loopholes | The name of new legislation (laws) introducing changes to the Fair Work Act and other workplace laws. |

| enterprise agreement | An enterprise agreement sets out minimum employment conditions and can apply to one business or a group of businesses. |

| Fair Work Commission (the Commission) | The national workplace relations tribunal and registered organisations regulator. The Commission makes awards, approves enterprise agreements and helps resolve issues at work. The Commission also regulates registered organisations. |

| labour hire worker | Someone employed by a labour hire agency (also called a staffing agency or employment agency). The agency can hire the worker out to a host. The worker has a contract with the agency, not with the host. |

| legislation | A set of laws. |

| National Employment Standards | The minimum employment entitlements that have to be provided to all employees. |

| non-small business employer | An employer with 15 or more employees at a particular time. Rules apply when calculating the number of employees. |

| protected attributes | Attributes or characteristics of a person that are protected from workplace discrimination. For example, age, religion, or social origin. |

| protected action ballot | A secret vote by eligible employees on whether they want to take industrial action. This action is usually about the terms of a proposed enterprise agreement. |

| redundancy | When an employee is terminated because the employer no longer requires that job to be done by anyone, except in cases of ordinary and customary turnover of staff. |

| small business employer | An employer with less than 15 employees at a particular time. If an employer has 15 or more employees at a particular time, they’re no longer a small business employer. Rules apply when calculating the number of employees. |

| workplace delegate | A workplace delegate is an employee appointed or elected under the rules of an employee organisation who represent members of the organisation in the workplace. |