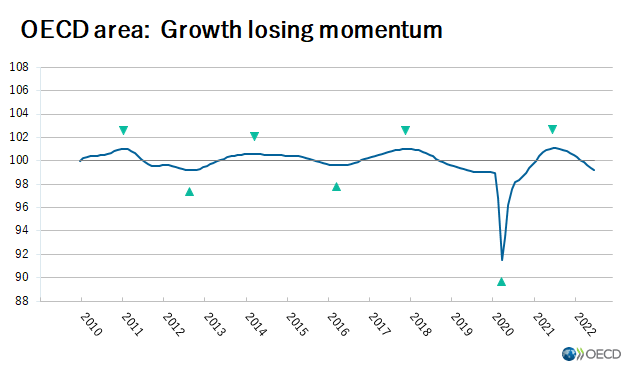

Leading indicators continue to point to a deteriorating growth outlook in most major economies

Download the entire news release (graphs and tables included – PDF)

9 Aug 2022 – The OECD Composite Leading Indicators (CLIs), designed to anticipate turning points in economic activity over the next six to nine months, continue to point to a deteriorating outlook in most major economies.

Dragged down by historically high inflation, low consumer confidence and declining share price indices, the CLIs remain below trend and continue to anticipate a loss of growth momentum in most large OECD economies. This is the case for Canada, the United Kingdom and the United States, as well as in the euro area as a whole including France, Germany and Italy. In Japan, the CLI continues to point to stable growth around trend.

Among major emerging-market economies, the CLI is still declining in China (industrial sector), though showing signs of stabilisation. In India, the assessment remains for stable growth, whereas in Brazil the CLI continues to point to slowing growth.

The OECD composite leading indicators are cyclical indicators based on a range of forward-looking indicators such as order books, building permits, confidence indicators, long-term interest rates, new car registrations and and many more. Most indicators are available up to July 2022.

Persisting uncertainties related to the war in Ukraine, renewed COVID-19 threats, supply chain disruptions and the impact of high inflation on real household income are resulting in larger-than-usual fluctuations in the CLI components. As a result, the indicators should be interpreted with care and their magnitude should be regarded as an indication of the strength of the signal rather than as a measure of growth in economic activity.

|

Visit the interactive OECD Data to explore this data further. |

> Access data:

- Composite Leading Indicators database

- Tables and graphs (PDF) of CLI and reference series for 33 OECD member countries and 6 major non-member economies.

Watch our video explaining howthe Composite Leading Indicators are compiled Please note that in the video “business cycle” should be understood as the growth cycle (deviation to trend), and that the term “recession” should be understood as an economic slowdown rather than a recession. |

Do you need help with our data? Please consult:

- FAQs

- Methodological information

- Glossary for Composite Leading Indicators and Business Tendency Surveys