40-year land price boom

“The increase in Australia’s residential land values in 2021 was broad-based, with sharp increases recorded across every state and territory, resulting in the total value of residential land increasing by about a third, which is a remarkable increase given the recessionary conditions we have been through at times” according to Pete Wargent of BuyersBuyers.

This is consistent with the Australian Bureau of Statistics that estimated that the value of residential land in Australia has increased from $4.9 trillion to $6.6 trillion in the 2021 financial year. However, homebuyers should understand how to interpret the headlines, according to Pete Wargent, co-founder of Australia’s first national marketplace for buyer’s agents, BuyersBuyers.

Mr Wargent said, “at face value, there has been a huge increase in the value of residential land, more than doubling over the past eight financial years. But it should also be recognised that more land will is being released and used for residential purposes as the population grows over time, so a good part of the increase in land values is baked in.”

“The demand or land for residential property purposes is exceptionally high right now. We expect to see a further increase in land values, and consequently, free-standing houses are highly likely to enjoy strong capital growth in the long term, in most of the established areas and landlocked suburbs in the country.”

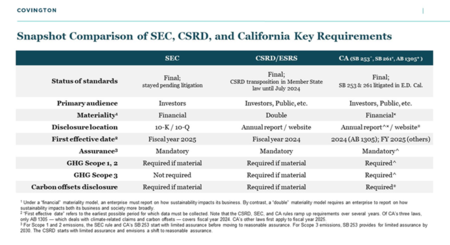

Figure 1 – Residential land values

Coastal land values outperforming

Doron Peleg, CEO of BuyersBuyers said that the growth in Australia’s population has been a key factor in rising land values, alongside structurally lower interest rates and an increase in Australian household wealth.

Mr Peleg said, “take the state of New South Wales, where the estimated resident population has increased by round 3 million over the past four decades, while the average number of persons per household has declined significantly, creating significantly more demand for residential land”.

“Although population growth in the state has slowed dramatically through the pandemic, there was a very rapid run-up from around 2006 onwards through the mining boom years and beyond” Mr Peleg said.

Figure 2 – Estimated Resident Population of NSW

“Australia’s economy has mostly been a success story over recent decades. The recent strength in land values has been driven primarily by coastal and lifestyle locations, as wealth as prime harbourside suburbs, as buyers have used flexible working arrangements and sought more space over the past two years.”

“We expect that the demand for land will remain strong, and land values are highly likely to deliver strong price increases, particularly in the long term” Mr Peleg said.

NSW land values set to pass $3 trillion

Pete Wargent, co-found of BuyersBuyers said “Warren Buffett said that when you’re buying stocks you should think about buying part ownership of a business. It’s a slightly different proposition when you’re dealing with residential land, because most market participants are buying homes to live in rather, than purchasing purely as an investment for the economic value, although you can apply similar principles.”

Mr Wargent said “the value of residential land in New South Wales hit A$2.67 trillion in the 2021 financial year, according to the Australian Bureau of Statistics estimates. For some interesting context, Apple became the first business in history to be valued at a US$3 trillion market capitalisation earlier this month”.

“To put that another way, and to paraphrase the great man Mr Buffett, for the same value of the Apple business today you could buy all of the residential land in the New South Wales and still be left with about a trillion Aussie dollars or so of walking around money.”

“Buffett also says that he likes to buy stocks with the assumption that the market could close next day and not open again for 10 years – and that’s not a bad mindset for property buyers to take either”.

“The total value of Australian residential land may appear to be at nosebleed levels at $6.6 trillion, but land values always feel expensive, and they will be much higher a decade or two from now” Mr Wargent said.

“A key drawcard for long-term investors in land and property is the survivorship factor. Apple is a wonderful business, no doubt – but nobody can say for sure which companies will be the most valuable in another four decades from now. 40 years ago in 1980 the largest corporations list was dominated by Big Oil and energy, Ford, General Motors, and IBM, for example, but the economic landscape has shifted dramatically away from the dominance of these businesses”.

“Property will continue to go through cycles, but well-located residential land in cities such as Sydney and the desirable coastal suburbs of New South Wales will still be in extremely high demand 40 years from now, hence its enduring popularity”.

“However, you need to know where to buy, as not every property on a large piece of land will deliver strong price appreciation – a forward-looking view and detailed analysis is required to identify sound opportunities in this highly competitive market” Mr Wargent said.