CommSec releases its latest SMSF Trading Trends Report.

CommSec’s SMSF Trading Trends Report has found self managed super funds (SMSFs) re-positioned their portfolios ahead of the Federal election in mid-May due to uncertainty around the Australian Labor Party’s proposed franking credit and negative gearing policies.

SMSF investors reduced their holdings of individual shares, instead favouring Exchange Traded Fund (ETFs) and Listed Investment Companies (LICs) in order to preserve capital and harvest yield amid heightened market volatility and lower interest rates. Investors also sought out higher growth US technology exposures in preference to China-focused companies as the trade war with the US re-intensified.

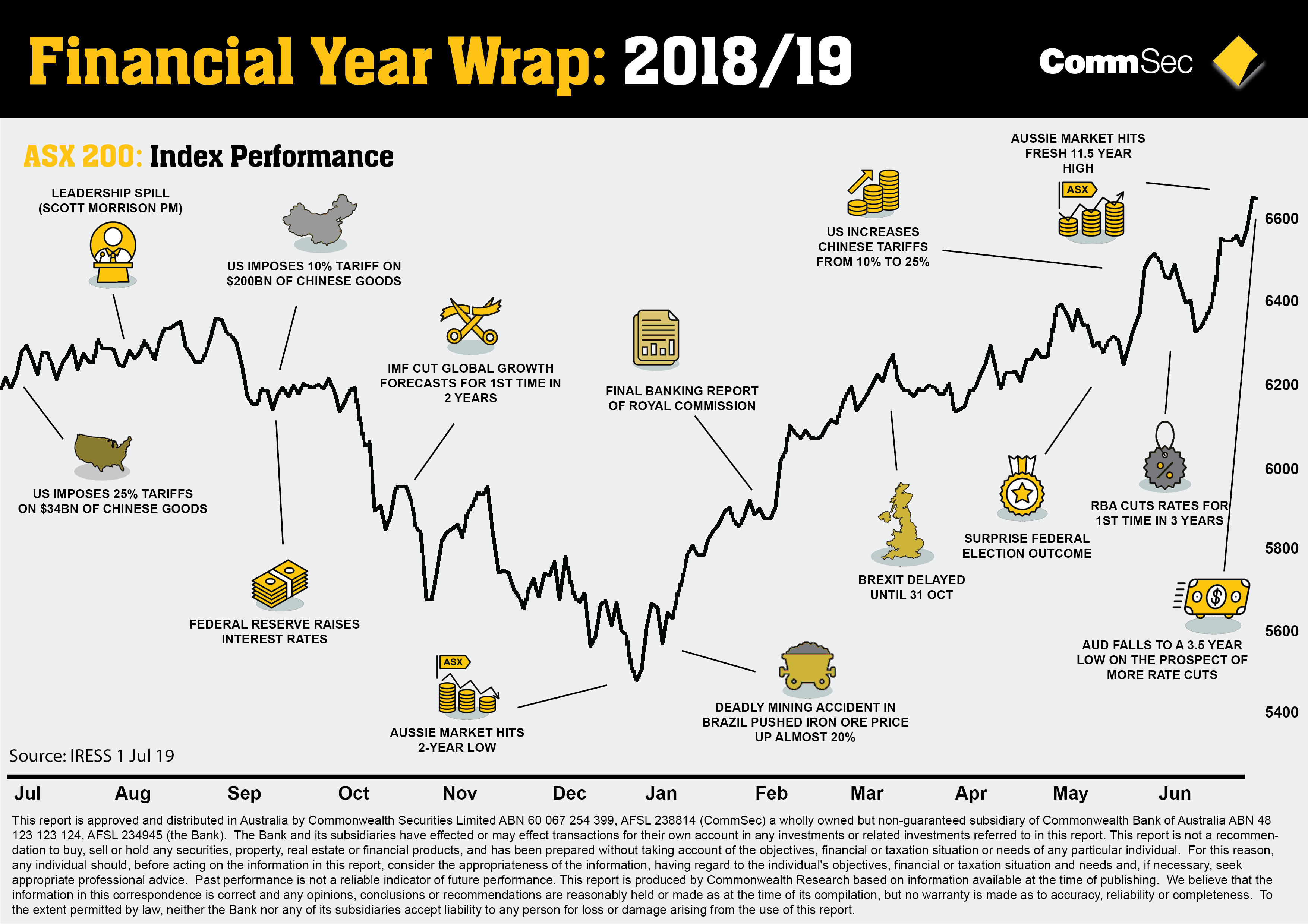

The latest report covers SMSF trading for the first half of 2019 and has found that while global sharemarkets bounced back strongly following a sharp sell-off in late 2018, investor sentiment continues to be impacted by mounting geo-political and global growth concerns. In response, the Reserve Bank of Australia cut the official cash rate by a quarter of a percent to a then record-low 1.25 per cent in early June.

Ryan Felsman, Senior Economist at CommSec said: “It has been a tricky first half of 2019 for investors, despite a decent rally in sharemarkets. The May Federal Election, the pivot to policy easing by global central banks, US-China trade tensions and mixed corporate earnings results have impacted investor sentiment over the past six months.

“In response, SMSFs have shifted their share trading activity from net buying to net selling. There was a broad focus on the financial, materials and telecommunication sectors, while specific positions on the big four banks and major miners were also reduced after a strong run in share prices. As trade values of these individual stocks rose in the first half of 2019, so did selling activity, reversing the buying trend of the previous six months.

“That said, we are continuing to see investors seek diversification through ETFs and LICs and chase yield through fixed income and higher-yield funds. Overall exposures to banks remain high given their higher yields and franking advantages, especially after the Federal election saw no change in policy around dividend imputation.”

In FY18/19, SMSFs were net buyers of ETFs by traded value, with buys accounting for 58 per cent of total traded value. LICs also remained popular among SMSFs, with a 6 per cent increase in total traded value, and a boost in the traded value of international LICs saw this segment contributing 29 per cent of the total LIC traded value.

Other key report findings:

- In what became a financial year of two halves, global and local sharemarkets bounced back strongly in the first half of 2019 – up by 17.2 per cent, the most since 1992 – after the widespread sell off in the last quarter of 2018. FY18/19 closed with markets approaching record highs, the All Ordinaries finished at 6699.20, up 6.5 per cent, and the S&P/ASX200 closed at 6618.80, up 6.8 per cent.

- Uncertainty over potential policy changes in the lead up to the Federal election saw SMSFs re-positioning their portfolios with a 15 per cent upswing in the total value of SMSF trades in the first six months of 2019 and a slight tilt towards selling.

- Global diversification continued to be an investment priority for SMSFs in the first half of 2019 with international funds representing 48.8 per cent of the traded value of ETFs, steady from 48.9 per cent in the previous six months.

- Direct international trades continue to slow with a further drop of 13 per cent in total traded value among SMSF investors. While Aussie-based tech firm Atlassian, which is listed on the Nasdaq index, made its first appearance in the top 20 international stocks by traded value.