Key points:

- Trade lamb indicator approaching record highs, as supply concerns lift

- Eastern states restocker lamb indicator reported at 1,003¢/kg cwt on Tuesday 18, 336¢ above year-ago levels

- Mutton prices remain elevated despite uncertainty in the China market

Mutton

Despite uncertainty in Australia’s largest mutton export market – China – the impact of dwindling supply, accelerated by the recent rain event, has propelled mutton prices to record levels.

Mutton prices typically peak at the beginning of winter before entering a period of decline in late July, albeit the indicator is often influenced by intermittent rainfall in any given year. Therefore, the recent price increase is perhaps unsurprising. However, the rise comes on the back of already elevated mutton prices, with the indicator on Tuesday 18 February reported at 672¢/kg carcase weight (cwt), a remarkable 255¢ above year-ago levels. The strength of the current market will provide some comfort to producers who opted to retain breeding ewes and supplementary feed in the past year.

Sheep and lamb supplies will remain tight from now until the spring. The extent to which prices have lifted since January is a sign that market participants are looking to sure up supplies, with the possibility prices could find further support until spring. In the short-term, developments in China could subdue mutton prices, with the US a likely beneficiary of increased mutton shipments – as was the case in January.

Lamb

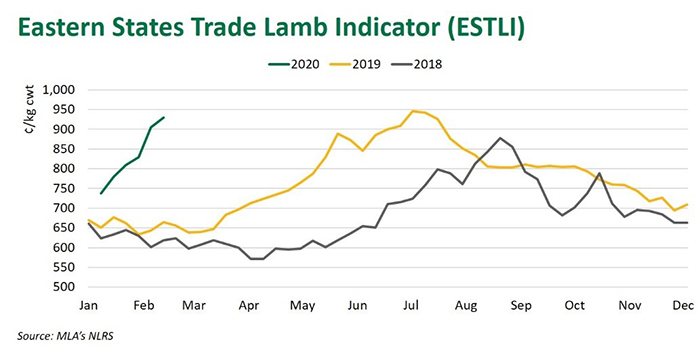

Lamb prices have sustained their unprecedented rise this week. Restockers have been actively looking to secure lighter weights, however demand continues to outweigh supply. On Tuesday 18 the restocker lamb indicator was reported at 1,003¢/kg cwt, 336¢ above year-ago levels.

On Tuesday, compared to year-ago levels, sharp increases have been recorded across all livestock categories:

Light lamb indicator was reported at 931¢/kg cwt, up 288¢ year-on-year

Trade lamb indicator was reported at 931¢/kg cwt, up 265¢ year-on-year

Heavy lamb indicator was reported at 930¢/kg cwt, up 257¢ year-on-year

Prices gained momentum despite an increase in yardings this week, as producers with lambs on hand look to take advantage of the strong prices. Major Victoria saleyards posted significant rises across yardings. On Wednesday, Horsham yarded 13,887, a 51% increase on the previous week. Hamilton recorded 22,752 lambs, a 56% increase on last week and Tuesday’s Ballarat sale posted 43,893 head, up 38% on the previous week. Similarly, across selling centres in New South Wales, Dubbo hit 15,740 head, up 58% and Tamworth yarded 1,800 head, an 80% increase on last week. The exception being Wagga, at 38,200 head, down 7% from the previous sale, however still providing dearer prices across all categories.

Processors continue to be active at saleyards, supporting price increases, as growing supply concerns look to be on the horizon.

A look at the NLRS reported eastern states weekly slaughter report for the week ending 14 February, highlights the easing supply trend across both sheep and lamb processing numbers.

New South Wales

Lamb: 96,519 head – back 9% year-on-year

Sheep: 48,608 head – back 22% year-on-year

Victoria

Lamb: 175,255 head – back 16% year-on-year

Sheep: 61,886 head – back 18% year-on-year

South Australia

Lamb: 48,742 head – back 12% year-on-year

Sheep: 9,288 head – back 55% year-on-year

© Meat & Livestock Australia Limited, 2020

To build your own custom report with MLA’s market information tool click here.

To view the specification of the indicators reported by MLA’s National Livestock Reporting Service click here.