Key points:

- Higher supply of young lambs in the Eastern States this July

- Lower price spread per weight category for trade and heavy lambs

- Lamb prices find support this week after a period of sharp decline

July has been a turbulent month for the Australian lamb market with New South Wales, Victoria and South Australia experiencing significant fluctuations across all prime lamb categories.

Subdued demand in key global markets, including the United States and United Arab Emirates, has been a contributing factor, with volumes down considerably from last year. As a result, saleyard and processor activity in the domestic market has come under pressure, with significant price fluctuations occurring from week to week. The mutton market has held steady in comparison to lamb categories, being the only indicator up on last year, driven by a sharp contraction in sheep turnoff.

Coinciding with external factors, there has been a higher number of new season lambs ready for slaughter entering the market compared to previous years. Young lambs to processors are up substantially to 43,000 head across New South Wales, Victoria and South Australia compared to July 2019 when very few new season lambs had entered the market, according to National Livestock Reporting Service (NLRS) data. Generally, new season lambs start to hit the market around the middle of August, peaking in October and November. This has spurred a larger influx of trade and export lambs and inversely fewer light lambs compared to last year, reflecting the improved season in key sheep regions. These trends highlight a challenging situation for producers, as supply has exceeded demand, furthering the impact on saleyard and grid prices.

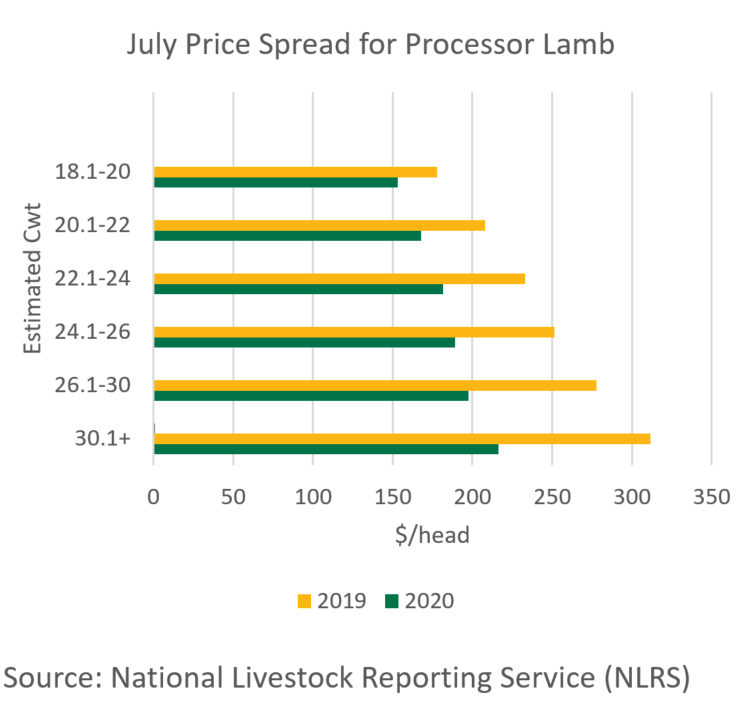

The Eastern States Trade Lamb Indicator on Tuesday 28 July was down 115¢/kg carcase weight (cwt) compared to last year, averaging $35/head less across New South Wales and Victoria. The heavy lamb indicator is tracking 236¢/kg cwt lower than last year, equating to $96/head less for heavy lambs averaging 34kg cwt, based on NLRS data. The volatility seen in July has been highlighted by prices paid per kilogram for processor lambs. The spread in prices across trade and heavy weight categories at saleyards has reduced significantly from last year, highlighting what processors are willing to pay for lambs given the challenging demand outlook.

Processor grid prices support what has been seen in the saleyard with heavier categories in Victoria and South Australia declining significantly, while New South Wales experienced no change on last week. This is also indicative of last week’s kill, with the New South Wales lamb kill up 27% and Victoria down 25% compared to the week prior. A return to the saleyard for some New South Wales processors has offered support to saleyard prices this week.

© Meat & Livestock Australia Limited, 2020

To build your own custom report with MLA’s market information tool click here.

To view the specification of the indicators reported by MLA’s National Livestock Reporting Service click here.