Key points:

- Multiple drivers on-farm and in the processing sector pushing down cattle prices.

- Current prices for cattle in Australia are significantly outperforming long-term averages.

- Australia currently does not have either FMD or LSD.

- There have been 6 times in the past 22 years where the EYCI has fallen further than the current drop in prices.

While the presence of both Foot and Mouth Disease (FMD) and Lumpy Skin Disease (LSD) in Indonesia have heightened concern in the Australian livestock industry, Managing Director for MLA, Jason Strong, says it’s important to consider perspective and a long-term view, when examining market drivers influencing the cattle market.

“Firstly, it is important to note that Australia does not have either disease on its shores,” Mr Strong said.

“However, clearly there is a heightened concern about the impact a potential incursion may have on our industry and this speculative angst is making its way to the saleyards.

“If we put this aside, there are a number of other sophisticated and tangible market forces putting downward pressure on market prices. These can be broken down into two key categories: on-farm and in the processing sector,” Mr Strong said.

On farm drivers include supply, mixed quality of livestock presented to market and the fact that the market is performing in typical winter fashion. With a comparatively wet and colder winter, the mixed quality of cattle supplied into the system is also impacting the price.

Meanwhile, in the processing sector, softer processor grid prices are affecting livestock markets as processors face multiple challenges including, continued absenteeism rates due to COVID-19 and influenza, as well as reduced processor capacity due to labour shortages.

“As processors work through these challenges, there is reduced demand between buyers at the saleyards,” Mr Strong said.

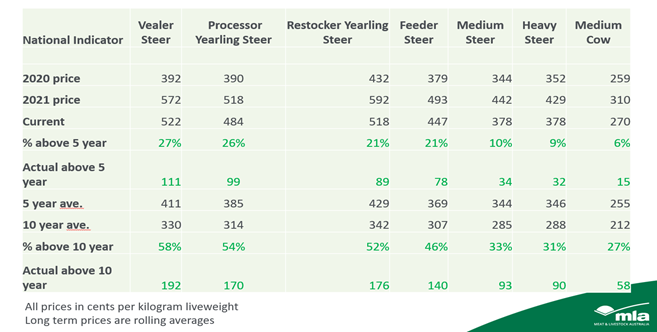

“It is also worth noting that the price reduction is off an all-time price high of 1,191c/kg cwt earlier this year, and although prices have fallen, we are still sitting 22% higher than the five-year average,” Mr Strong said.

Impact of market drivers

These technical and sometimes typical market drivers for this time of year are all significant and are having an impact on market performance.

There is not one driver playing more of a role than the other – rather, as a combination of factors occurring at the same time, they’re all contributing equally to this current slide in prices.

Long-term perspective

While market prices have fallen for now, bringing these prices into perspective by taking a broader long-term view on their performance is critical, according to Mr Strong.

“In the second half of 2021, cattle prices continually reached record levels. Comparing current market performance to year-ago levels does not paint an accurate picture of performance after they have softened from such high,” Mr Strong said.

As of Wednesday 27 July 2022, current cattle market prices compared to the 5-year and 10-year (see Table 1) averages demonstrates the comparative strength of the market.